The E.W. Scripps Company (SSP) shares were down 2.2% on August 6 after the diversified media company reported mixed Q2 results.

Revenues jumped 57% year-over-year to $565 million and exceeded consensus estimates of $551.41 million. The increase in revenue was attributable to a rebound in the advertising marketplace, as well as a positive contribution from its January acquisition of ION Media.

However, the adjusted loss of $0.14 per share lagged analysts’ expectations of earnings of $0.29 per share. The company reported an adjusted loss of $0.22 per share in the prior-year period. (See E.W. Scripps stock charts on TipRanks)

Segment-wise, Local Media adjusted revenue grew 22% year-over-year to $325 million, driven by a 48% jump in core advertising revenues. Additionally, Scripps Networks adjusted revenue was up 23% to $239 million, reflecting continued strength in direct response advertising.

Encouragingly, Scripps CEO Adam Symson commented, “Our second-quarter results illustrate the benefits of the company’s strategic approach in recent years to both longer-term transformative change and near-term operating-performance excellence.

“Our improved financial profile today positions us well for ongoing business growth, future free cash flow generation and the ability to continue reducing our debt.”

Looking forward, the company provided guidance for the third quarter. Local Media revenues are expected to be down in the mid-teens, whereas Scripps Networks revenues are likely to be up in mid-teens.

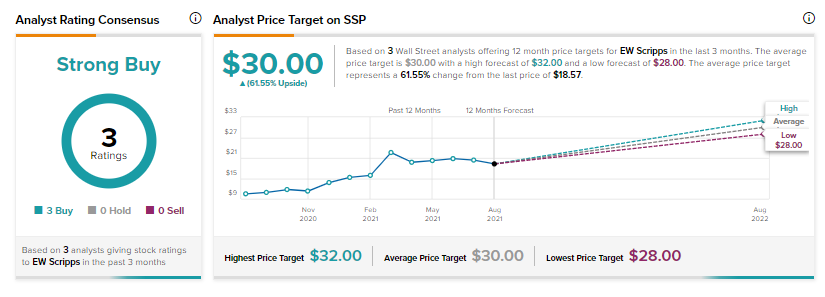

Following the Q2 earnings announcement, Noble Financial analyst Michael Kupinski maintained a Buy rating and increased the price target to $32 (73.4% upside potential) on the stock.

Kupinski also increased his revenue and EBITDA estimates, based on strong revenue momentum and expectations of reduced expenses going forward.

Overall, the stock has a Strong Buy consensus rating based on three unanimous Buys. The average E.W. Scripps price target of $30 implies 61.6% upside potential from current levels. Shares of SSP have jumped 72% over the past year.

Related News:

Itron Reports Q2 Miss and Cuts FY21 Guidance; Shares Crash 26.4%

Groupon Reports Impressive Earnings; Shares Surge 16%

Carvana Delivers First Quarterly Profit; Shares Gain 9%