DuPont (DD) announced the commencement of its planned split-off exchange offer for its Nutrition & Biosciences (N&B) business.

The exchange offer provides DuPont common shareholders with an option to exchange all or a portion of their shares for shares of N&B, which will be later converted into shares of International Flavors & Fragrances (IFF). The company stated that the exchange offer would expire on January 29, 2021.

The offer forms a part of DuPont’s “Reverse Morris Trust” arrangement with International Flavors & Fragrances, which was announced a year ago. Under the arrangement, DuPont had agreed to split-off its N&B business and then combine it with IFF.

DuPont said, “Following the exchange offer, N&B will merge with a subsidiary of IFF and become a wholly-owned subsidiary of IFF, and shares of N&B common stock will be converted into shares of IFF common stock. In the merger the N&B shares will convert into IFF shares on a 1.0:1.0 basis, so participants in the exchange offer will instead receive shares of IFF common stock in the merger.”

Last month, Delaware’s Supreme Court upheld a March 2020 judgement of the dismissal of a lawsuit against DuPont wherein the company was accused of massively downplaying the cost of environmental liabilities imposed on spin-off company Chemours. (See DD stock analysis on TipRanks)

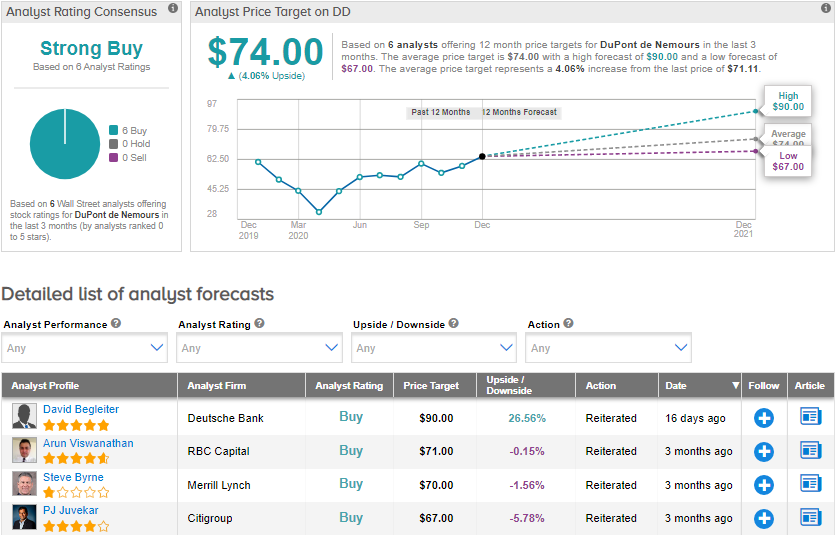

Following the ruling, Deutsche Bank analyst David Begleiter raised the stock’s price target to $90 (26.6% upside potential) from $65 and reiterated a Buy rating. Begleiter believes that the ruling will lead to a new cost arrangement between the two companies, which will lessen investors’ concern over DuPont’s PFOA (Perfluorooctanoic Acid) exposure.

Like Begleiter, the rest of the Street also has a bullish outlook on the stock. The Strong Buy analyst consensus is based on 6 unanimous Buys. Meanwhile, the average analyst price target stands at $74, and implies 4.1% upside potential at current levels. Shares were up 10.8% in 2020.

Related News:

Gold Resource In Leadership Reshuffle After NMU Spinoff; Shares Drop 5%

Ford Calls Off Joint Venture With Mahindra; Street Says Hold

Southwest Airlines Signs Agreement with Sabre; Street Sees 14% Upside