Ahead of the U.S. government’s upcoming price negotiations for ten major drugs under the Inflation Reduction Act, major pharmaceutical companies are reportedly set to hike prices on over 500 medications this January. The government, looking to curb costs, is set to reveal discounted prices for these drugs in September, leveraging the new powers granted by the Act to negotiate directly with drugmakers for Medicare-covered drugs.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

According to Reuters, citing 3 Axis Advisors, the price increases are not just a preemptive move against negotiations but also a response to inflation, rising manufacturing costs, and potential supply chain issues due to conflicts in the Middle East.

In a contrasting move, GSK (NYSE:GSK) and two other companies are gearing up to reduce prices on at least 15 drugs in January, following earlier price cuts on insulin products to avoid penalties under the American Rescue Plan Act of 2021. Despite these reductions, the trend since 2019 has been an approximate 5% annual price increase in drugs, with 2023 seeing hikes on 1,425 drugs. Furthermore, there’s been an even steeper rise in the cost of newly launched drugs, with prices for new drugs increasing by about 20% annually from 2008 to 2021.

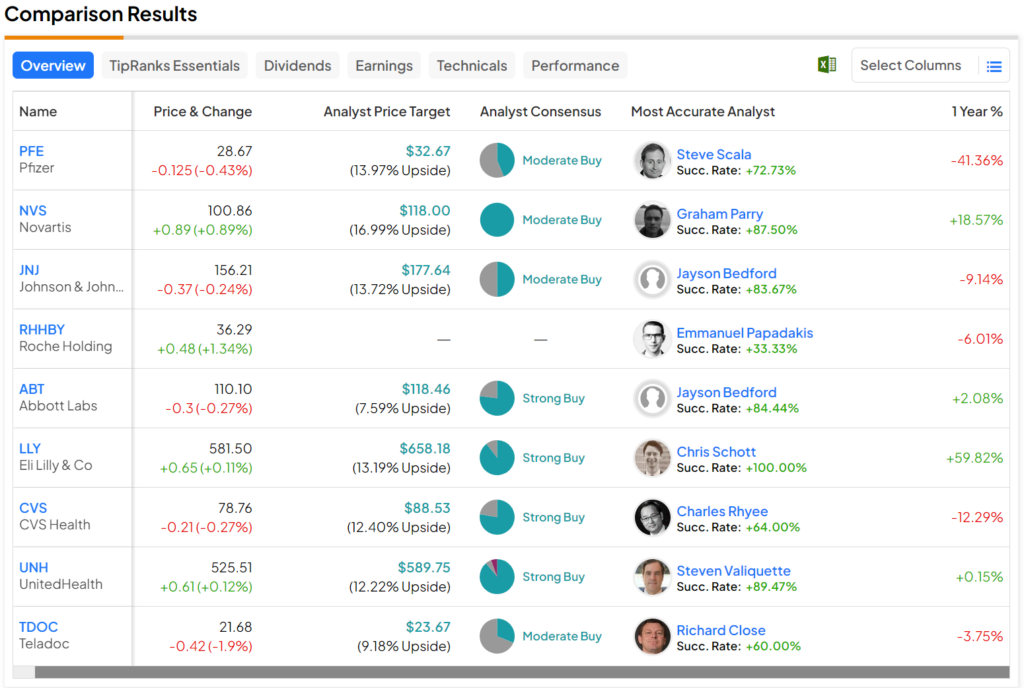

What is the Best Healthcare Stock to Invest In?

During 2023, the best healthcare stock to invest in was Eli Lilly (NYSE:LLY), as its shares gained almost 60% over the past 12 months. However, as we head into 2024, it appears that Wall Street analysts expect the most from Novartis (NYSE:NVS). Indeed, its average price target of $118 per share implies 17% upside potential.