AbbVie (ABBV) announced on Monday that it has entered into a partnership with Jacobio Pharmaceuticals, to jointly develop and commercialize SHP2 inhibitors, which target a key node in cancer and immune cells.

Financial terms of the partnership were not disclosed. Under the terms of the agreement, AbbVie will be granted an exclusive license to the SHP2 portfolio. Meanwhile, Jacobio will continue to conduct early global clinical trials of JAB-3068 and JAB-3312 inhibitors, while AbbVie will cover the R&D expenses.

SHP2 is a protein mediator of cellular signaling. Many tumors have genetic mutations, driving abnormal cancer cell growth which relies on SHP2 activity. SHP2 also plays a key role to control cytokine production and immune cell response.

Therefore, inhibition of SHP2 is believed to have dual effects by potentially reducing cancer cell growth and modulating immune responses to generate anti-tumor activities. Jacobio’s early clinical stage SHP2 assets, JAB-3068 and JAB-3312, are oral small molecules designed to specifically inhibit SHP2 activity.

“Identifying promising new targeted approaches for solid tumor patients is a high priority for us,” said Mohit Trikha, vice president at AbbVie. “Jacobio’s SHP2 program has the potential to treat cancer patients across many tumor types. By targeting a key node in both cancer and immune cell signaling pathways, SHP2 inhibition, both as a monotherapy and potentially in combination with other agents, may rapidly advance new treatment options for cancer patients.”

Upon completion of the trials, AbbVie will be in charge of global development and commercialization. Jacobio has an option, exercisable before the initiation of registrational trials, to exclusively develop and commercialize the SHP2 program in mainland China, Hong Kong, and Macau.

The partnership is still subject to clearance under the Hart-Scott-Rodino Antitrust Improvements Act.

Since March 23, AbbVie shares have jumped 44% on the back of its recent acquisition of Botox maker Allergan and solid revenues of Humira, the company’s successful immunosuppressive anti-inflammatory drug. However with an expired patent, competition is growing.

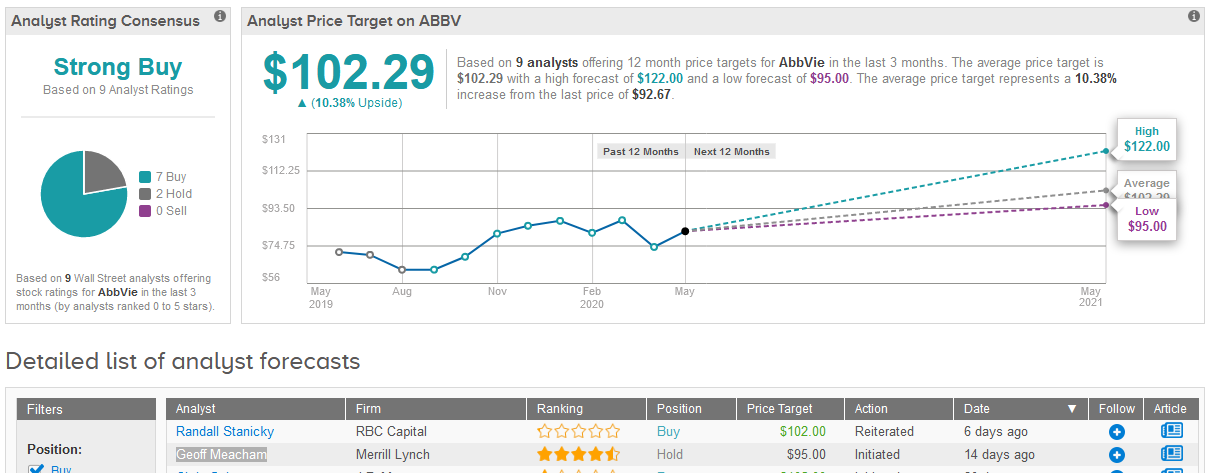

Five-star analyst Geoff Meacham at BofA Merrill Lynch last month reinstated coverage of AbbVie with a Hold rating and a $95 price target citing the “uncertainty of top-line resiliency given Humira’s impending 2022 loss of exclusivity”.

The analyst, who expects a 1% sales decline through 2021-2025, argues that AbbVie stock fairly reflects the headwinds from Humira offset by the Allergan new product portfolio.

Overall, Wall Street analysts are more upbeat about AbbVie’s stock outlook. In a review of 9 analysts, the stock scores 7 Buys and the rest are Holds adding up to a Strong Buy consensus. The $102.29 average price target indicates another 10% upside potential in the coming 12 months. (See Abbvie’s stock analysis on TipRanks).

Related News:

Immutep Surges In Pre-Market On Positive Efti Cancer Data

Pfizer Loses 6% On Disappointing Ibrance Breast Cancer Outcome

Novavax Seeks To Make 1 Billion Covid-19 Vaccine Doses