American sports betting and online gaming operator DraftKings Inc. (DKNG) reported weaker-than-expected third-quarter results, with revenue and earnings both failing to meet expectations. Shares fell 2.4%, closing at $43.62 on November 5.

Weaker-Than-Expected Quarterly Results

The company’s revenue increased 60% year-over-year to $212.82 million, but failed to meet the consensus estimate of $232.5 million.

Similarly, quarterly loss stood at $1.35 per share, up 21.6% compared to the prior-year quarter, and higher than the analyst estimated loss of $1.11 per share.

On a positive note, DraftKings’ Monthly Unique Payers (MUPs) grew 31% year-over-year, and the Average Revenue per MUP (ARPMUP) jumped 38% compared to Q3FY20.

The MUP growth reflects the company’s solid payer retention and acquisition, across both Sportsbook and iGaming segments, coupled with their launch into new states. Furthermore, strong growth in ARPMUP was driven by continued momentum and mix shift in Sportsbook, iGaming offerings, increased cross-selling opportunities, and stronger user engagement.

Management Comments

Commenting on the results, DraftKings co-founder, CEO, and Chairman of the Board of Directors, Jason Robins, said, “DraftKings had a strong third quarter that highlights our team’s unique ability to drive engagement with our core customers, while simultaneously launching new states and verticals, and completing the complex migration to our in-house technology ahead of schedule.”

Robins added, “Since migrating, we have rapidly added innovative features and functionality to our top-ranked mobile sports betting app. We are also excited that our new growth initiatives, including DraftKings Marketplace, and our content and media business, demonstrated promising early results in the quarter.”

See Analysts’ Top Stocks on TipRanks >>

Guidance

Based on the current business momentum, DKNG reduced the midpoint of its FY21 revenue guidance to $1.26 billion, and further reduced the revenue range to be between $1.24-$1.28 billion, albeit the consensus is pegged at $1.28 billion.

Moreover, the company anticipates FY 2022 revenue to fall in the range of $1.7-$1.9 billion, against the consensus of $1.77 billion.

Analysts’ Take

In response to DKNG’s quarterly performance, Needham analyst Bernie McTernan maintained a Buy rating on the stock, with a price target of $73, which implies a whopping 67.35% upside potential to current levels.

McTernan said, “We note we believe our estimates were in-line with company guidance while consensus was above – on a reported basis DKNG missed 3Q consensus by ~10%, but beat by 7% on an adjusted basis.”

As per the analyst, DKNG is a leader in the emerging North American online gaming market, with a total addressable market (TAM) opportunity of $35 billion. Additionally, he sees upside potential in TAM, with a favorable legislative environment and launch opportunity across more states.

Meanwhile, the Wall Street Community is cautiously optimistic about the stock with a Moderate Buy consensus rating based on 11 Buys, 6 Holds, and 1 Sell. The average DraftKings price target of $68.13 implies 56.19% upside potential to current levels. Shares have gained 5.1% over the past year.

Website Traffic

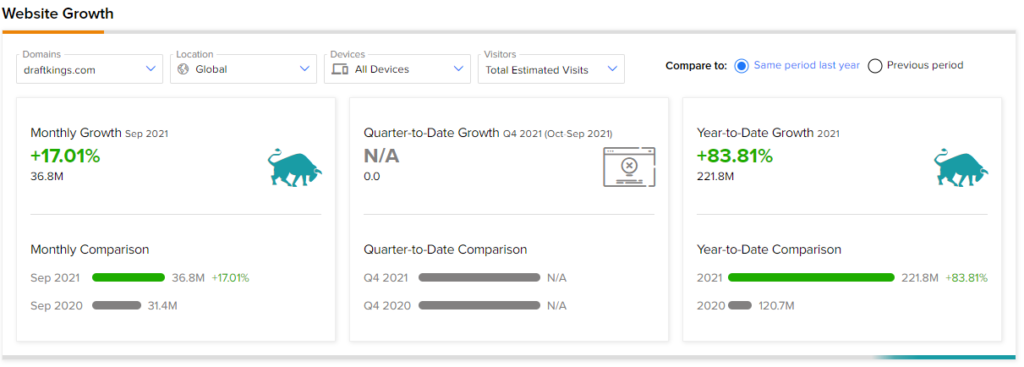

TipRanks’ Website Traffic tool, which uses data from SEMrush Holdings (SEMR), the world’s biggest website usage monitoring service, offers insight into DraftKings’ performance.

According to the tool, in September, the DraftKings website recorded a 17.01% monthly increase in global visits compared to the previous year. Likewise, year-to-date website traffic growth has increased 83.81%, against the same period last year.

Related News

Peloton Plummets on Poor Q1 Results

ViacomCBS Falls Despite Stellar Q3 Results

Moderna Plunges 17.9% on Missed Q3 Expectations