Shares in DraftKings (DKNG) sank almost 7% in pre-market trading after the U.S. sports betting company announced a public offering to sell its common stock.

The stock dropped to $37.80 in early market trading. DraftKings said it has commenced an underwritten public offering of 33 million shares of its Class A common stock, consisting of 14 million shares offered by DraftKings and 19 million shares offered by some of the company’s shareholders.

The stockholders intend to grant the underwriters a 30-day option to purchase up to an additional 4.95 million shares of Class A common stock. DraftKings will not receive any proceeds from the sale of Class A common stock offered by the stockholders. The offering is subject to market and other conditions, and there can be no assurance as to whether or when the offering may be completed.

DraftKings said it intends to use the net proceeds it receives from the offering for general corporate purposes. Goldman Sachs & Co. and Credit Suisse Securities (USA) are acting as joint book-running managers.

The share sale offering comes after the sports gambling went public at the end of April. Since the Nasdaq debut, the stock has more than doubled and is trading at $40.57 as of Tuesday’s close.

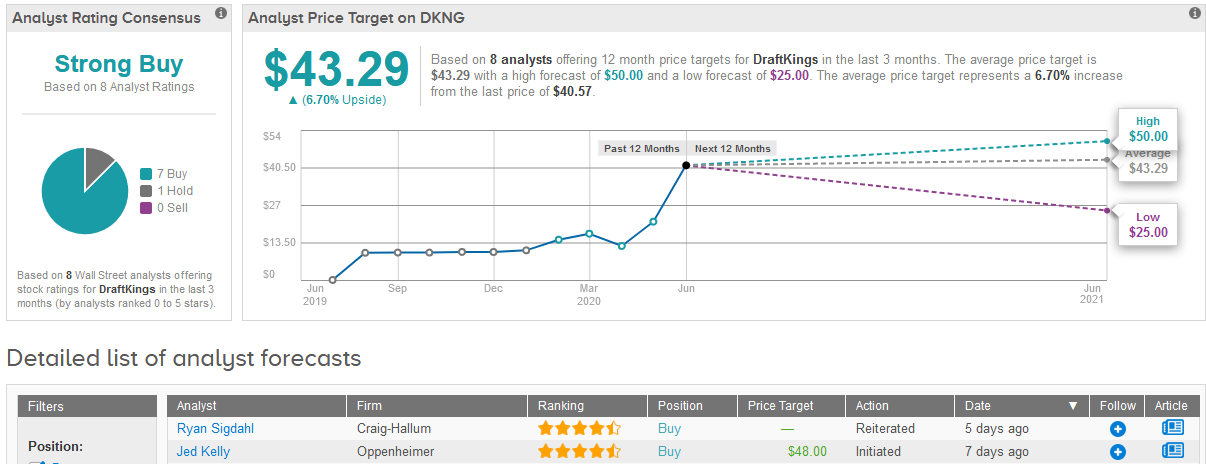

Five-star analyst Jed Kelly at Oppenheimer last week initiated coverage of the stock with a Buy rating and a $48 price target.

“As more states legalize sports gambling, we believe competencies in product development and customer acquisition will allow the company to be a critical player in accelerating the shift in US sports betting from ~$150 billion wagered illegally/ offshore to licensed domestic operators,” Kelly wrote in a note to investors.

Although legalized sports betting and iGaming markets are in their very early stages of growth, Kelly estimates for the US legal sports wagering market to grow about 43% annually, reaching about $8 billion by 2025, and $14.4 billion by 2028 as more states regulate sports gaming. The analyst expects DraftKings to achieve about 25% market share.

“While a premium valuation and high cash flow burn likely create above-average volatility near term, we emphasize the long-term nature of our rating,” Kelly added.

The stock scores 7 Buy ratings versus 1 Hold rating adding up to a Strong Buy analyst consensus. The $43.29 average price target implies 6.7% upside potential in the shares over the coming year. (See DraftKings stock analysis on TipRanks).

Related News:

iQIYI Pops 35% In Pre-Market On Report Tencent Seeks To Buy Big Stake

Nio Completes $428M ADS Offering, Stock Now Up 70% YTD

Google Mulling Purchase of Stake in Indian Vodafone Idea