DraftKings, a sports betting company, announced the acquisition of BlueRibbon Software Ltd., a Tel Aviv-based global jackpot and gamification company. The financial terms of the deal were not disclosed.

The acquisition is expected to enhance DraftKings’ (DKNG) customer experience with the integration of BlueRibbon’s unique jackpot functionality, which includes personalized promotions and rewards tailored to the individual customer or jackpots that pay out across DraftKings’ various product offerings, the company said.

DraftKings’ Global Technology and Product President Paul Liberman said, “Integrating BlueRibbon’s proprietary, proven technology will enable DraftKings to create dynamic incentives for our users as they engage with our products.”

“The team at BlueRibbon brings technical and gamification expertise and broad industry experience to DraftKings, and we are excited to leverage this technology to further differentiate our product offerings and engage customers in new ways,” Liberman added. (See DraftKings stock analysis on TipRanks)

DraftKings plans to fully integrate BlueRibbon’s leadership and current staff base located in Tel Aviv into its existing global workforce. Furthermore, the company intends to hire more people in the Tel Aviv office.

Last week, the company announced the acquisition of Vegas Sports Information Network, Inc. (VSiN), a multi-platform broadcast and content company, to boost content for customers. The financial terms of the deal were also not disclosed.

On March 30, Oppenheimer analyst Jed Kelly maintained a Buy rating and a price target of $80 (27.7% upside potential).

Kelly said, “DKNG is bolstering its media strategy with the acquisition of Vegas Sports Information Network. We are incrementally positive on the acquisition as we believe it positions DKNG to 1) further build out its content capabilities to a sports betting centric content consumer; 2) make a broader push into streaming; 3) deepen their presence in Las Vegas; and 4) create unique betting products integrated with VSiN content and personalities.”

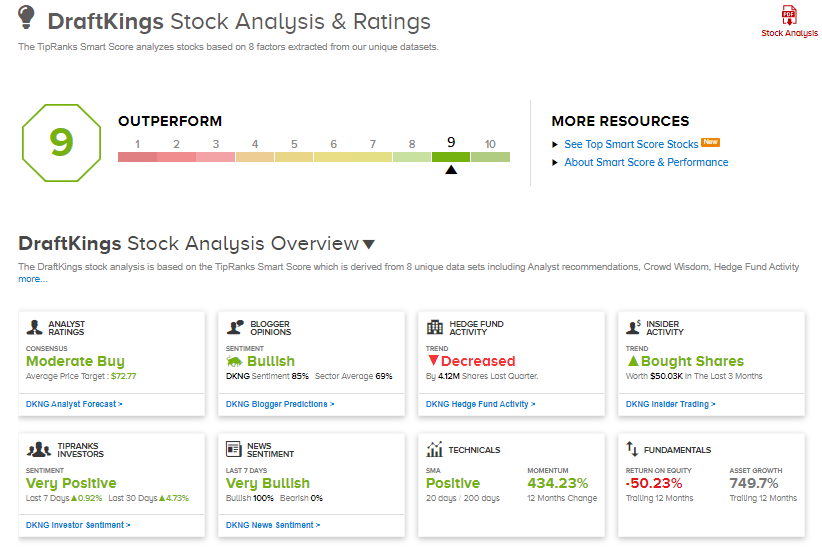

The rest of the Street is cautiously optimistic about the stock with a Moderate Buy consensus rating. That’s based on 16 Buys, 6 Holds, and 1 Sell. The average analyst price target of $72.77 implies 16.2% upside potential to current levels. Shares have skyrocketed 396.7% over the past year.

DraftKings scores a 9 out of 10 from TipRanks’ Smart Score rating system, indicating that the stock has strong potential to outperform market expectations.

Related News:

Pioneer Natural To Buy DoublePoint Energy For $6.4B; Shares Fall Pre-Market

CarMax’s Quarterly Profit Beats Analysts’ Expectations; Shares Tank 7%

Q2 Holdings Inks Deal To Acquire ClickSWITCH; Shares Gain