The U.S. Department of Transportation (DOT) is in the early stages of a “rigorous and comprehensive” investigation into Southwest Airlines’ (NYSE:LUV) holiday debacle that led to the cancellation of over 16,700 flights from December 21 to December 31, 2022.

DOT is investigating if Southwest sold more flight tickets than it could handle. It is reviewing whether “Southwest executives engaged in unrealistic scheduling of flights which under federal law is considered an unfair and deceptive practice,” a DOT spokesperson said on Wednesday. It is also monitoring the entire situation to ensure that Southwest complies with rules about refunding the affected customers and reimbursing expenses.

Southwest said it will “cooperate with any inquiry or request from government oversight or elected officials.” In its defense, the carrier stated that its holiday schedule was “thoughtfully designed” with “ample staffing.” It added, “while working to recover, our systems and processes became stressed by multiple days of flight cancellations across 50 airports in the wake of an unprecedented storm.”

Southwest is scheduled to announce its Q4 2022 results on January 26. Analysts expect the carrier to post a loss per share of $0.08 compared to EPS of $0.14 in the prior-year quarter. Earlier this month, Southwest said that it expects to report a net loss for Q4 2022 due to the operational disruptions in December. It projected a pre-tax impact in the range of $725 million to $825 million on the bottom line and a revenue loss of $400 million to $425 million due to flight cancellations.

Is LUV a Good Stock to Buy?

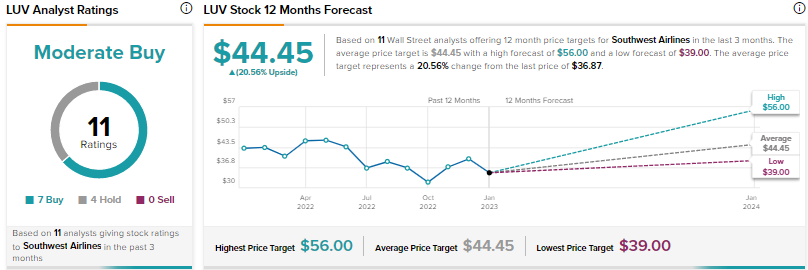

Wall Street is cautiously optimistic about Southwest Airlines, with a Moderate Buy consensus rating based on seven Buys and four Holds. The average LUV stock price target of $44.45 implies 20.6% upside. Shares have advanced 14% year-to-date.