American on-demand food delivery service platform DoorDash (DASH) reported mixed first quarter fiscal 2022 results, with revenue beating but earnings missing expectations. The delivery platform continues to attract high orders as the underlying demand remains robust.

DASH stock spiked 7.6% during extended trading on the news, paring the losses of the intraday session where the stock plunged 10.4% amid a broader market sell-off. Year-to-date, the stock has lost 49.7%.

DoorDash witnessed superior quarterly performance on the back of marketplace gross order volume (GOV) growth of 25% year-over-year to $12.4 billion. What’s more, the company even saw record high growth in monthly active users (MAUs) and DashPass members, as well as a significant jump in its average order frequency on the back of new customer acquisitions and healthy dasher supply.

Mixed Q1 Results

DoorDash’s quarterly revenue rose 35% year-over-year to $1.456 billion and meaningfully surpassed the Street estimates of $1.38 billion. The huge revenue growth was supported by a 23% jump in total orders to $404 million and marketplace GOV growth compared to the prior year’s quarter.

On the earnings front, however, DoorDash’s diluted loss of $0.48 per share came in 7 cents wider than analysts’ estimated loss of $0.41 per share and was much higher than the prior year’s loss of $0.34 per share.

2022 Outlook

Based on the current business momentum and reaping the benefits of the continued investment in the business, DoorDash expects Q2FY22 Marketplace GOV to fall between $12.1 billion and $12.5 billion, and adjusted earnings before interest, tax, depreciation, and amortization (EBITDA) is expected to break even or earn up to $100 million.

Furthermore, for the full year 2022 Marketplace GOV is forecasted to be between $49 billion and $51 billion, and EBITDA is expected to break even or earn up to $500 million.

Analysts’ View

Impressed by DoorDash’s quarterly performance with record MAUs, DashPass members, and order frequency, JMP Securities analyst Andrew Boone reiterated a Buy rating on the stock with a price target of $200, which implies a whopping 173.4% upside potential to current levels.

“We believe DoorDash’s offering of selection, convenience, and value is resonating with consumers and we expect delivery (especially with work from home) will be a persistent trend that lasts beyond the pandemic,” Boone noted.

Boone believes that DoorDash will continue to grow its 50%+ market share of the domestic food ordering market due to adoption of DoorPass, newer verticals such as advertising, and a higher shift of the on-demand home delivery market to online.

Meanwhile, other analysts on the Street are cautiously optimistic about the stock, with a Moderate Buy consensus rating based on ten Buys and six Holds. The average DoorDash price forecast of $159.63 implies 118.2% upside potential to current levels.

Website Traffic

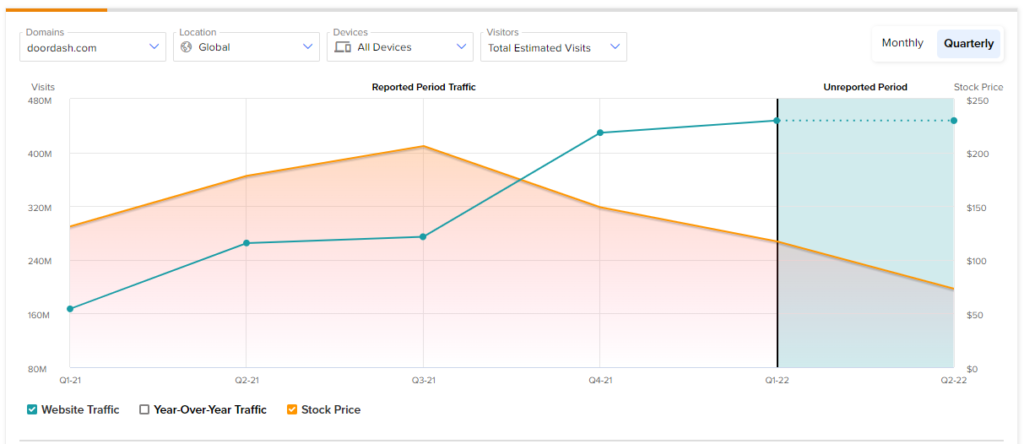

According to TipRanks Website Traffic Tool, in Q1, the estimated global visits to the DoorDash website across all devices had increased by 4.2% sequentially and 168.1% year-over-year.

The trend indicated ahead of the earnings that DoorDash was set to report a strong quarter based on the estimated website visits. Meanwhile, the stock price fell 21.3% during the quarter, signaling the unsupported sell-off in the market and the huge potential for an upward trajectory.

Ending Notes

DoorDash undoubtedly has proven its worth both during and after the pandemic. The home-delivery service provider is here to stay with a growing number of users being attracted every day owing to the convenience provided. Plus, there is massive upside potential for the average price target and the growing website visits that indicate a bright future for the stock’s performance.

Discover new investment ideas with data you can trust

Read full Disclaimer & Disclosure

Related News:

Despite Mixed Q1 Results, New York Times Shares Gain 3.6%

Moderna Stock Gets a Booster Dose of Upbeat Q1 Results

Etsy’s Muted Q2 Guidance Spooks Investors