The controversy, pontificating, and legal drama surrounding student loan payments has finally come to an end, or so we think. But now, we can see the fallout already starting to form as DoorDash (NYSE:DASH) took a rating cut at Moffett Nathanson. With the cut, DoorDash stock slipped over 3% in Friday afternoon’s trading.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

DoorDash dropped from “outperform” to “market perform,” as Moffett Nathanson suggested that delivery food was likely to be considered a “luxury” with the start of student loan repayments taking a bite out of already-strained household budgets. Thus, those households impacted by such issues are likely to trim DoorDash food delivery and instead stick to somewhat less-expensive cooking at home and the like. Moffett Nathanson also cut the price target on DoorDash from its original $110 per share down to $93.

DoorDash was having troubles enough as it was, but there may be even more reason for DoorDash to be cut out of household budgets altogether. One incident—complete with video—made it to NBC as a DoorDash delivery driver was spotted potentially spitting on a customer’s order after having a problem with the amount of a tip. Another similarly distressing moment came as a DoorDash driver turned porch pirate seized a customer’s Amazon package after dropping off an order. With food delivery representing a roughly 60% price premium against picking it up yourself, it’s easy to see why DoorDash’s business might decline.

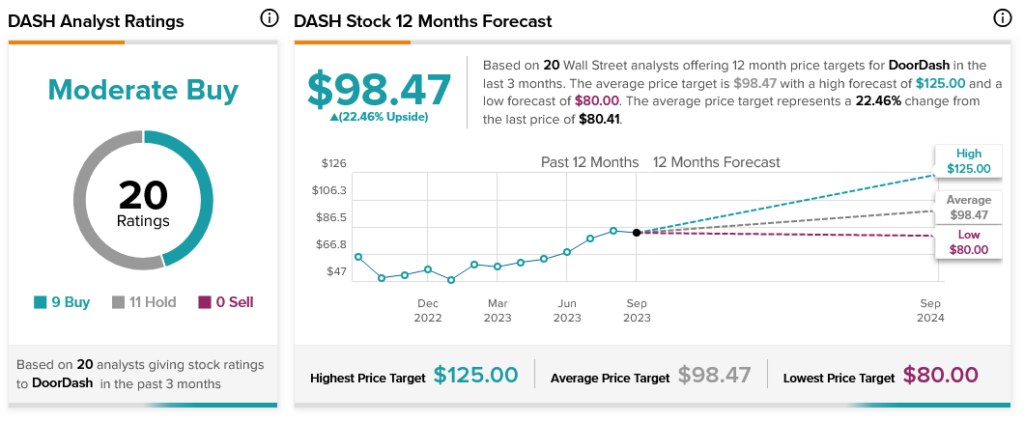

Analysts, meanwhile, are turning increasingly skeptical. DoorDash stands as a Moderate Buy by analyst consensus, with nine Buy ratings against 11 Holds. Further, with an average price target of $98.47, DoorDash stock offers investors 22.46% upside potential.