Donaldson Company, Inc. (DCI) reported better-than-expected Q3 results driven by strength across all regions.

Donaldson is a technology-led filtration product and solutions company, serving a broad range of industries and advanced markets.

The company reported earnings of $0.66 per share, up 32% year-over-year, that surpassed the Street’s estimates of $0.58 per share.

Revenue came in at $765 million, up 21.5% from the year-ago period, and beat analysts’ expectations of $707.59 million. Compared to the prior year, Engine product sales grew 26.3%, while Industrial product sales were up 11.8%. (See Donaldson stock analysis on TipRanks)

Commenting on the company’s performance, Tod Carpenter, Chairman, President, and CEO of the company said, “Donaldson’s third quarter sales were the highest quarterly sales in our 106-year history and reflected strength in the economy as seen in our Engine segment and the beginning of recovery in our Industrial segment.”

Carpenter added, “With one quarter left in our fiscal year and customer demand at a high level for most of our businesses, we are confident the sales momentum we experienced in the third quarter will carry through our fiscal year-end.”

Based on strong Q3 results, the company is raising its guidance for Fiscal 2021. The company now forecasts adjusted earnings in the range of $2.28 to $2.34 per share, while the consensus estimate is pegged at $2.21 per share. Revenue is projected to grow 9% to 11% compared to FY2020.

Following the results, Oppenheimer analyst Bryan Blair assigned a Hold rating on the stock and said, “We view Donaldson as a high-quality industrial company with a long track record of delivering above-average growth at attractive ROIC. While Donaldson looks increasingly well positioned over the intermediate term, current valuation appears to fairly reflect the company’s solid operating trajectory and top/bottom-line rebound potential amid continued macro uncertainty.”

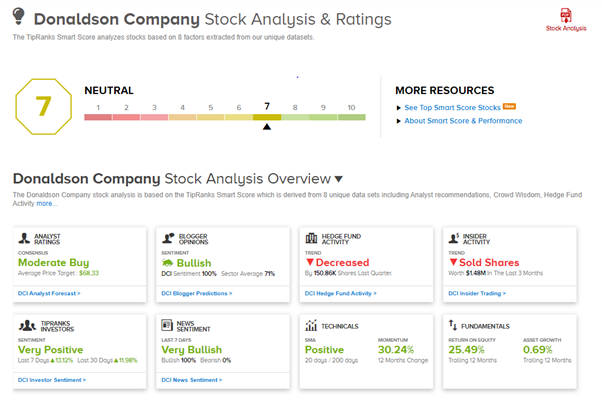

The stock has a Moderate Buy consensus rating based on 2 Buys and 2 Holds. The average analyst price target of $69 implies 9.8% upside potential to current levels. Shares have gained 26.6% over the past year.

According to TipRanks’ Smart Score system, Donaldson gets a 7 out of 10, which indicates that the stock is likely to perform in line with market averages.

Related News:

Zoom Q1 Earnings & Revenue Outperform; Raises FY22 Guidance

Iteris Reports Q4 Loss, Beats Revenue Expectations

Old National and First Midwest Ink All-Stock Merger Deal