Domino’s Pizza (NYSE: DPZ) posted revenues of $1.07 billion in the third quarter, up 7.1% year-over-year, in line with Street estimates. Diluted earnings for the pizza chain came in at $2.79 per share, a drop of 13.9% year-over-year and falling short of analysts’ estimates of $2.97.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

Meanwhile, while same-store sales at Domino’s in the U.S. were up 2% year-over-year, same-store sales internationally declined 1.8% year-over-year, excluding the impact of currency fluctuations.

Moreover, at the end of Q3, Domino’s also sold 114 of its company-owned stores in Arizona and Utah to certain of its franchisees for $41.1 million

Is Domino’s Stock a Buy?

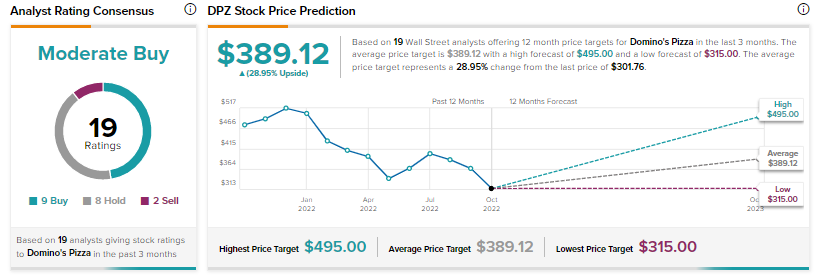

Analysts are cautiously optimistic about DPZ with a Moderate Buy consensus rating based on nine Buys, eight Holds, and two Sells.

The average price forecast for DPZ stock is $389.12 implying an upside potential of 28.9% at current levels.