DocuSign reported better-than-expected fiscal 4Q (ended Jan. 31) results driven by rising demand for digital agreements. However, shares of the digital-signature company declined nearly 4% in Thursday’s extended trading session after closing 5.9% higher on the day.

DocuSign’s (DOCU) 4Q adjusted earnings more than tripled to $0.37 per share on a year-over-year basis and outpaced Street estimates of $0.22 per share. Revenues jumped 57% to $430.9 million topping analysts’ expectations of $407.65 million.

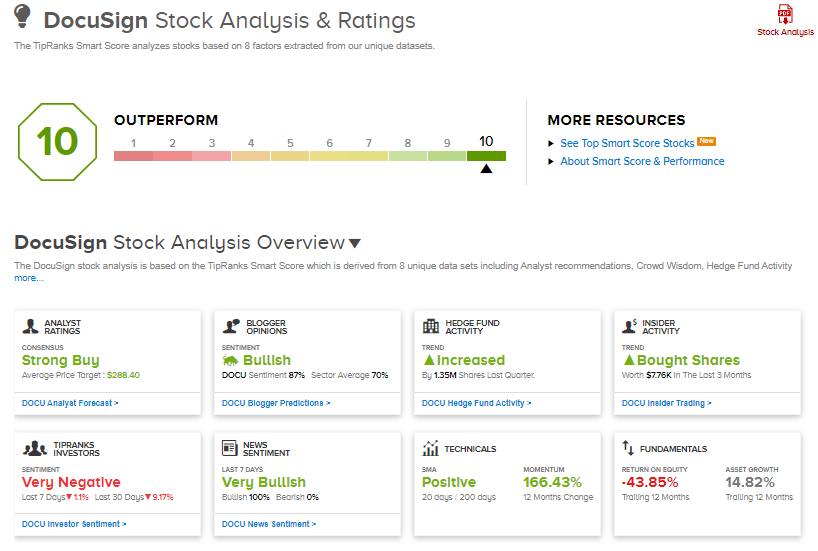

The company’s subscription revenue came in at $410.2 million in the quarter, up 59% year-over-year. Billings grew 46% to $534.9 million. (See DocuSign stock analysis on TipRanks)

DocuSign CEO Dan Springer said, “Fiscal 2021 was a milestone year for DocuSign. We became a pillar of the ‘anywhere economy’ that lets people increasingly do anything in life and work from anywhere.”

For the fiscal year 2022, the company anticipates total revenue of $1.963 billion to $1.973 billion, versus the consensus estimate of $1.89 billion. Subscription revenue is forecasted in the range of $1.886 billion to $1.896 billion.

For the fiscal 1Q, DocuSign projects sales to be in the range of $432 million to $436 million, versus analysts’ expectations of $419.69 million. Subscription revenue is expected to land between $415 million and $419 million.

On March 3, Citigroup analyst Tyler Radke initiated coverage on the stock with a Buy rating and a price target of $282 (25.2% upside potential).

The analyst believes “the COVID boost supports a higher for longer growth trajectory for the company.”

DocuSign shares have exploded 228% over the past year, while Wall Street analysts are still bullish about the stock. The Strong Buy consensus rating boasts 6 unanimous Buys. Looking ahead, the average analyst price target stands at $288.40, putting the upside potential at 28% over the next 12 months.

Additionally, DocuSign scores a “Perfect 10” from TipRanks’ Smart Score rating system, indicating that the stock has strong potential to outperform market expectations.

Related News:

Franchise Group’s Fiscal Year 2021 Outlook Beats Estimates After Surprise 4Q Loss

Asana Posts Smaller-Than-Expected Quarterly Loss As Sales Outperform

Dick’s Sporting Goods’ Quarterly Profit Pops 84% As Online Buying Booms; Shares Sink