On Monday, The Walt Disney Company announced the reorganization of its media and entertainment businesses to focus on its direct-to-consumer strategy given the rapid success of Disney+ streaming service amid the pandemic.

Under the new structure, Disney (DIS) will have three content groups – Studios, General Entertainment and Sports. These three groups will be responsible for producing and delivering content for theatrical, linear and streaming platforms, with the primary focus being the company’s streaming services, which include Disney+, Hulu and ESPN+.

Also, Disney will form a single Media and Entertainment Distribution group, which will look after the global distribution and commercialization of content and will also oversee operations of the streaming services.

The Studios group will function under the leadership of Alan F. Horn and Alan Bergman while the General Entertainment and Sports groups will be led by Peter Rice and James Pitaro, respectively. The Media and Entertainment Distribution group will be run by Kareem Daniel, who formerly served as Disney’s President, Consumer Products, Games and Publishing.

The Disney Parks, Experiences and Products division will continue to operate under its existing structure under the leadership of Josh D’Amaro.

The Covid-19 pandemic has significantly impacted Disney and other players in the entertainment industry. It brought movie production to a standstill while the business from Disney’s theme parks and movie theatres continues to be weak even after the reopening of several locations following the easing of restrictions.

However, the stay-at-home orders have significantly boosted the demand for streaming services with Disney+ gaining over 60 million subscribers globally by early August since its launch in November 2019.

Last week, activist investor Dan Loeb sent a letter to Disney’s CEO Bob Chapek, urging the media giant to permanently suspend its $3 billion annual dividends and channelize those funds to Disney+. (See DIS stock analysis on TipRanks)

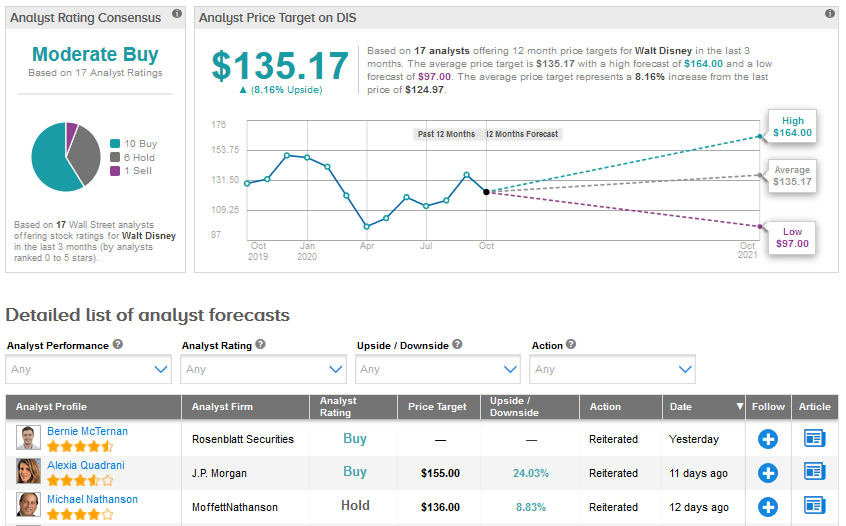

On Oct. 2, J.P. Morgan analyst Alexia Quadrani raised Disney’s price target to $155 from $135 and maintained a Buy rating, saying that the stock has “retreated a bit” from the early September rebound, thus creating an attractive entry point. The analyst is encouraged by the progress of recovery in each of Disney’s businesses.

The Street’s Moderate Buy consensus for Disney breaks down into 10 Buys, 6 Holds and 1 Sell. The average analyst price target of $135.17 indicates an 8.2% upside potential in the coming months, with shares down 13.6% year-to-date.

Related News:

Twilio Stock Gains 7.7% On $3.2B Segment Deal; Street Stays Bullish

Bandwidth Snaps Up Voxbone In $527M Cloud Communications Deal; Shares Rise 4%

Wix Teams Up With Vodafone For UK Expansion; Shares Now Up 138% YTD