Digital Turbine reported better-than-expected 3Q results fueled by strong demand for its application media and content media service offerings. Shares of the company surged 14.8% in Wednesday’s extended trading session.

Digital Turbine’s (APPS) 3Q adjusted EPS increased over four-fold to $0.21 from $0.05 in the year-ago quarter and surpassed analysts’ expectations of $0.17. Total revenue jumped 146% to $88.6 million, exceeding the consensus mark of $75.9 million.

Revenues from its application media business soared 58% to $56.9 million year-over-year. Sales from the content media unit came in at $31.7 million. (See Digital Turbine stock analysis on TipRanks)

For fiscal 2021, Digital Turbine forecasted revenues of between $298 million and $300 million. Adjusted earnings are expected to come in at approximately $0.67 per share.

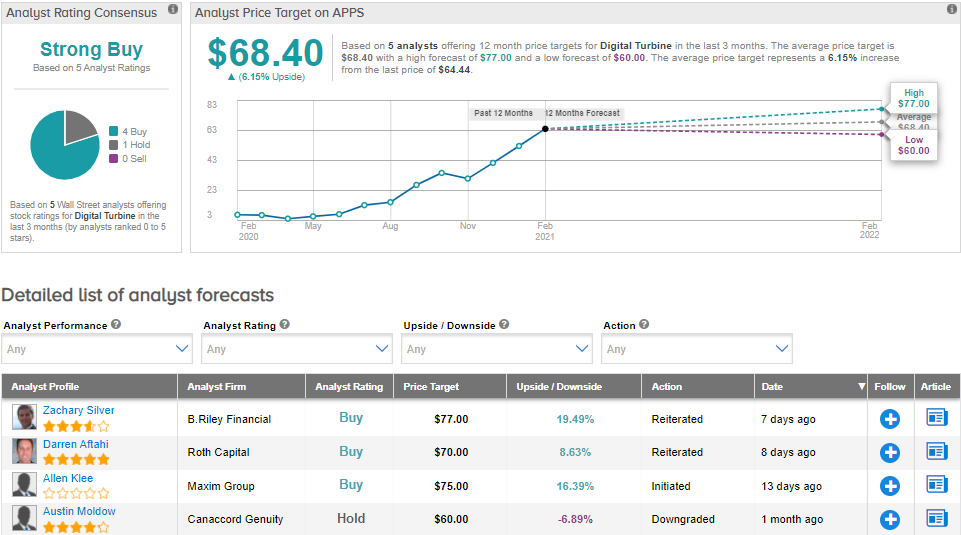

On Jan. 28, B.Riley Financial analyst Zachary Silver reiterated Buy rating on the stock with a price target of $77 (19.5% upside potential). In a note to investors, Silver wrote, “While APPS’s share price surged in 2020, we believe that the company’s unique and durable positioning within the mobile app advertising ecosystem and high degree of operating leverage remain underappreciated by the Street.”

The rest of the Street has a bullish outlook on the stock with a Strong Buy consensus rating based on 4 Buys versus 1 Hold. The average analyst price target of $68.40 implies upside potential of about 6.2% to current levels. That’s after shares skyrocketed more than 891% over the past year.

Related News:

PayPal Jumps 5.5% As 4Q Sales Outperform; Street Sticks To Buy

MetLife’s 4Q Profit Beats Estimates; Shares Gain

Costco’s January Sales Surge 18% As E-Commerce Booms; Street Is Bullish