Sporting goods retailer DICK’s Sporting Goods (NYSE:DKS) announced an impressive set of third-quarter results, with EPS of $2.85, exceeding expectations by $0.40. Further, its top line ticked higher by 2.8% year-over-year to $3.04 billion, outpacing estimates by $100 million. Consequently, the company’s shares jumped by nearly 8% in today’s pre-market session.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

During the quarter, comparable store sales rose by 1.7% thanks to an increase in transactions and average ticket size. In addition, the company ended the quarter with a total store count of 869.

Furthermore, DKS incurred charges of $52.5 million associated with its business optimization drive. The company expects to incur further charges of $10 million related to these efforts in the fourth quarter.

Looking ahead to Fiscal Year 2023, DKS expects comparable store sales growth to be in the range of 0.5% to 2%. EPS for the year is anticipated to be between $12 and $12.60.

In addition, the company declared a quarterly dividend of $1 per share. The DKS dividend is payable on December 29 to investors of record on December 15.

Is DKS a Good Stock to Buy?

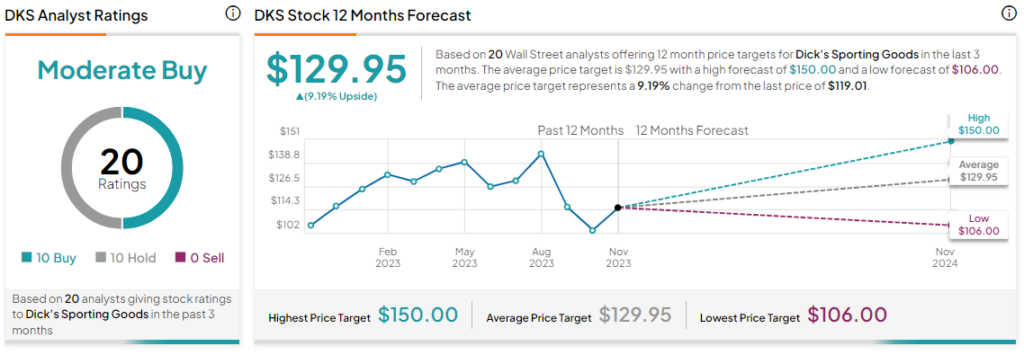

Overall, the Street has a Moderate Buy consensus rating on DICK’s Sporting Goods. After a nearly 10% rise in the company’s shares over the past month, the average DKS price target of $129.95 implies a modest 9.2% potential upside.

Read full Disclosure