Shares of Diana Shipping (NYSE: DSX) gained 5.8% on May 24 to close near its 52-week highs at $6.36 after the global shipping company reported upbeat first-quarter results.

Adding to investors’ excitement, the company increased its quarterly dividend by 25%, to $0.25 per share.

Q1 Beat

Notably, adjusted earnings of $0.31 per share beat analysts’ expectations of $0.28 per share. Moreover, it was much superior to the reported loss of $0.03 per share for the prior-year period.

Similarly, revenues jumped an impressive 60% year-over-year to $65.93 billion and exceeded consensus estimates of $64.14 billion. The increase in revenues reflects a surge in average time charter rates, offsetting decreased ownership days.

25% Dividend Hike

Concurrent with earnings, the company raised its quarterly dividend by 25% to $0.25 per share. The dividend is payable on June 17 to shareholders on record as of June 6.

Wall Street’s Take

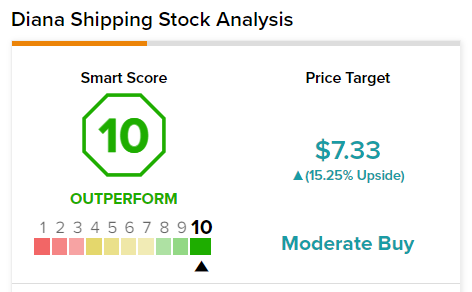

DSX has a Moderate Buy consensus rating based on two Buys and one Hold. The average Diana Shipping stock forecast of $7.33 implies 21.16% upside potential to current levels.

TipRanks’ Smart Score

DSX scores a “Perfect 10” on TipRanks’ Smart Score rating system, indicating that the stock has strong potential to outperform market expectations.

Concluding Thoughts

Shares of Diana Shipping have jumped 62.2% over the past year, massively beating the underlying benchmark indexes.

An upbeat quarterly result, in the midst of difficult macro conditions where the big stalwarts on the global stock exchanges are reporting unexpected misses, is truly commendable.

Furthermore, the company’s move to increase its quarterly dividend by 25% exudes its confidence in its underlying robust fundamentals.

Discover new investment ideas with data you can trust.

Read full Disclaimer & Disclosure

Related News:

Booz Allen Hamilton Posts Q4 Beat & Issues Muted Guidance

AstraZeneca Wins EU Approval for COVID-19 Vaccine as Booster

Why Does Apple Want to Shift Its Base From China to India & Vietnam?