Deckers Outdoor Corp. (DECK) delivered strong Q4 and FY21 results driven by the exceptional performance of the HOKA and UGG brands. Deckers is a global leader in designing, marketing, and distributing innovative footwear, apparel, and accessories.

The company’s Q4 earnings stood at $1.18 per share, up 107% from the year-ago period and outpaced Street’s estimates of $0.64 per share.

Net sales for the quarter came in at $561.19 million, up 49.7%, and surpassed Street estimates of $437.09 million.

The FY21 earnings stood at $13.47 per share, up 39.9% from the year-ago period, and net sales reported for the full year came in at $2.55 billion, up 19.4% year-over-year. Shares of the company soared 6% in the extended trading session on May 20.

Net sales for the UGG® brand were up 53.1% in Q4 and up 12.9% for FY21, while net sales for the HOKA ONE ONE® brand were up 74.2% in Q4 and up 62.0% for FY21. (See Deckers Outdoor’s stock analysis on TipRanks)

Dave Powers, President, and CEO of the company said, “While our fourth quarter benefited from certain macro tailwinds as well as lapping last year’s disruption, the health of our brands, strength of our omni-channel organization, and our digitally focused long-term strategies provided the foundation for success over the past year, accelerating our growth trajectory. We are excited for the year ahead as we invest in the long-term evolution of Deckers to drive sustainable top and bottom-line growth.”

For the full year 2022, the company forecasts net sales to fall in the range of $2.95 billion to $3 billion, compared to consensus estimates of $2.70 billion.

The company forecasts full-year earnings to be in the range of $14.05 – $14.65 per share, compared to a consensus of $14.50 per share.

Recently, Merrill Lynch analyst Rafe Jadrosich lifted his price target to $385 from $380 while maintaining a Buy rating. The target price implies 23.7% upside potential to current levels.

Commenting on the upcoming Q4 results, Jadrosich had stated that he expected DECK to outperform the Street’s estimates owing to strong web traffic witnessed in the UGG and HOKA brands. However, he saw lower growth potential compared to prior quarters due to constraints in inventory and shipping capacity.

Consensus among analysts is a Strong Buy based on 5 unanimous Buys. The average analyst price target stands at $403, which implies upside potential of 29.5% to current levels. Shares have gained 20.9% in the last six months.

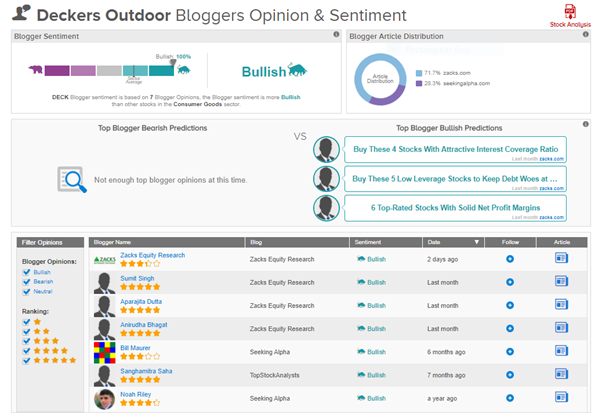

TipRanks data shows that financial blogger opinions are 100% Bullish on DECK, compared to a sector average of 70%.

Related News:

Palo Alto Networks Beats Q3 Expectations; Shares Pop 6% After Hours

Ford and SK Innovation Ink Battery Cell Manufacturing Joint Venture

Rritual Superfoods Teams Up With NEXE for Compostable Products