Datadog, Inc. (DDOG) shares surged over 11% to close at $185.51 on November 5, approaching its 52-week high, after delivering blowout third-quarter results and raising its FY2021 outlook. The company offers monitoring and Software-as-a-Service (SaaS)-based security data analytics platform for cloud applications.

Impressive Quarterly Figures

The positive quarterly results were driven by robust performance across customer segments and products, aided by strong demand for digital transformation and cloud migration throughout organizations.

Encouragingly, adjusted earnings of $0.13 per share more than doubled year-over-year, massively outpacing analysts’ expectations of $0.06 per share. The company reported earnings of $0.05 per share in the same quarter last year. (See Datadog stock charts on TipRanks)

Similarly, revenues jumped 75% year-over-year to $270 million, exceeding consensus estimates of $247.73 million.

Notably, customers with annual recurring revenue (ARR) of $100,000 or more grew 66% to 1,082 customers, against the same period last year.

Datadog Raises FY2021 Outlook

Adding to investors’ optimism, the company raised the financial guidance for FY2021 based on robust Q3 results, and issued the fourth-quarter outlook, significantly higher than Street expectations.

The company now forecasts FY2021 adjusted earnings in the range of $0.39 to $0.40 per share, against the previous guidance range of $0.26 to $0.28 per share. Revenues are forecasted to be in the range of $993 million to $995 million, against the previously guided range of $938 million to $944 million.

Q4 adjusted earnings are likely to range from $0.11 and $0.12 per share, while the consensus estimate is pegged at $0.06 per share. Revenues are projected to be in the range of $290 million to 292 million, against the consensus estimate of $263.3 million.

Management Weighs In

Sharing his views on new products and features, Datadog CEO, Olivier Pomel, commented, “With ten new products and major features announced at our annual user conference, Dash, we are continuing to innovate at a rapid pace.”

He further added, “We are broadening our observability platform, further developing our Cloud Security Platform, and launching the general availability of CI Visibility, which represents a major step towards shift-left observability for developer workflows.”

Wall Street’s Take

Based on the upbeat Q3 results, Morgan Stanley analyst Sanjit Singh increased the price target on Datadog to $200 (7.8% upside potential) from $164, while reiterating a Buy rating.

Singh attributed the price target hike to strong Q3 results, and increased FY2021 revenue growth outlook to 65%.

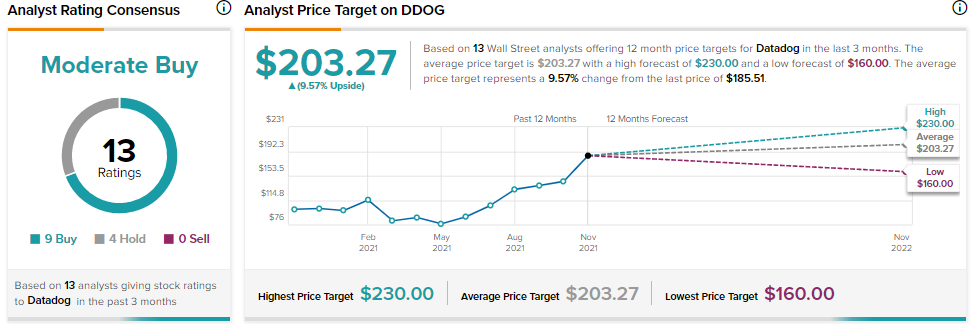

Meanwhile, the rest of the Wall Street community is cautiously optimistic about the stock, with a Moderate Buy consensus rating based on 9 Buys and 4 Holds. The average Datadog price target of $203.27 implies 9.57% upside potential to current levels.

Related News:

Exela Dips 11.5% on Quarterly Loss

Qualcomm Posts a Blowout Quarter; Shares Jump 7.5%

Roku’s Q3 Revenues & Q4 Outlook Disappoint