Denmark’s largest bank, the Danske Bank (OTC:DNKEY) (DE:DSN), will forfeit $2 billion in settlement to resolve a four-year-long money-laundering case involving a former branch in Estonia, which was sued for illegally moving Russian money to the West.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

The illegal and unchecked transactions occurred between 2008 and 2016 when bankers at Danske Bank’s Estonia branch enabled large amounts of non-resident customers’ money to be transferred to banks in the U.S. As of early 2014, the bank was aware of the potentially illegal transactions by its Estonian customers but failed to take appropriate action. Investigations began in 2018 after large volumes of unchecked transactions were discovered.

A total of $160 billion was processed by the branch through U.S. banks fraudulently on behalf of its nonresident customers.

The U.S. Justice Department is set to receive $1.21 billion, and the Securities Exchange Commission (SEC) will receive $178.6 million of the penalty.

The settlement will put an end to the bank’s probes by the U.S. and Denmark. However, the bank’s updated anti-money-laundering regulations and compliance measures will probably still be scrutinized.

Wall Street Weighs In

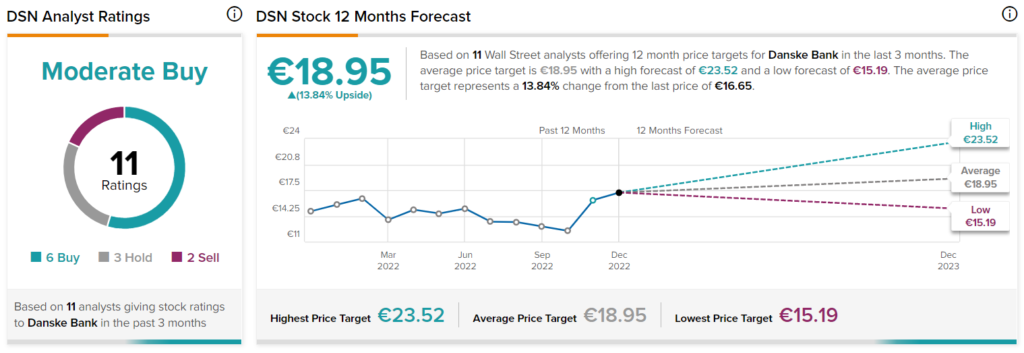

Wall Street is Moderately bullish on DNKEY stock, with a Moderate Buy consensus rating based on six Buys, three Holds, and two Sells. The average price target of €18.95 indicates a 13.84% upside.