CrowdStrike shares rallied 13.6% in pre-market trading today as the cloud-based cybersecurity provider delivered better-than-expected growth for the third quarter of fiscal 2021 (ended Oct. 31) and significantly raised its full-year earnings guidance.

The 3Q revenue grew 86% year-over-year to $232.5 million, surpassing analysts’ forecast of $212.6 million. CrowdStrike’s (CRWD) top line gained from an 87% rise in subscription revenue to $213.5 million. Increased digitization and a rapid shift to the cloud have been boosting the demand for cybersecurity companies.

The quarter saw 1,186 net new subscriptions, including 64 from the acquisition of Preempt Security. The company ended the quarter with 8,416 total subscription customers, reflecting an 85% year-over-year rise.

Strong demand helped the company flip to an adjusted EPS of $0.08 in 3Q FY21, compared to a net loss per share of $0.07 in 3Q FY20. Analysts were expecting the company to break-even on an adjusted basis. (See CRWD stock analysis on TipRanks)

CrowdStrike upgraded its full-year guidance and now expects FY21 revenue of $855 million-$860 million compared to the prior outlook of $809.1 million-$826.7 million. It now sees FY21 EPS of $0.21-$0.22 compared to the previous forecast of $0.02-$0.08.

In reaction to the upbeat results, Robert W. Baird analyst Jonathan Ruykhaver increased his price target to $185 from $155 and reiterated a Buy rating. In a note to investors, the 5-star analyst stated, “Wins cited in the quarter clearly point to strong competitive positioning vs. both legacy and next-gen peers. Going forward, we expect CrowdStrike to continue to take share in endpoint where legacy players have failed to innovate in addition to growing in newer markets like cloud workload protection.”

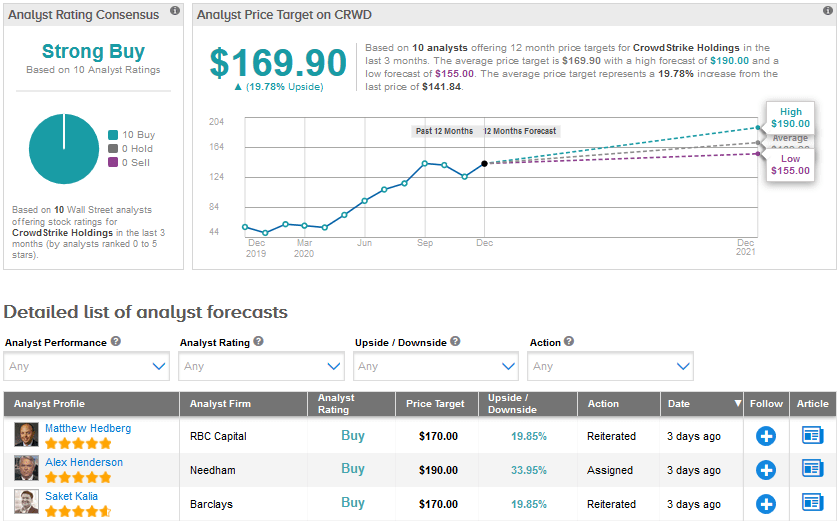

The rest of the Street mirrors Ruykhaver’s bullish stance, with a Strong Buy analyst consensus based on 10 unanimous Buys. With shares surging a whopping 184.4% year-to-date, the average price target of $169.90 indicates an upside potential of about 20% over the coming year.

Related News:

Okta Jumps 9% As Cloud Demand Boosts Sales; Analyst Lifts PT

Hewlett Packard Raises FY21 Profit Guidance After 4Q Beats The Street

Lightspeed Acquires Upserve To Grow In The US Hospitality Market; Shares Rise 4%