Crocs reported its highest quarterly revenues, which jumped 56.5% in the fourth quarter on a year-over-year basis. However, shares fell 5% in Tuesday’s midday trading.

Crocs (CROX) recorded $411.5 million in sales in 4Q, beating analysts’ estimates of $399.51 million. The casual footwear company also saw record FY20 revenues of $1.4 billion, up by 12.6% year-on-year. The company reported adjusted diluted earnings per share (EPS) of $1.06 that came in ahead of analysts’ expectations of $0.78.

Crocs CEO Andrew Rees said, “We achieved record fourth quarter revenues and profitability and finished 2020 with very strong brand momentum. We are looking forward to an exceptional 2021 with accelerated revenue growth as we invest in digital, China, and our supply chain to support future growth. I am confident in our ability to continue to deliver outstanding profitability and strong cash flow.”

Revenues growth in FY20 was fuelled by strong digital sales, which surged 50.2% year-on-year and represented 41.5% of the company’s revenues. Crocs’ direct-to-consumer comparable sales that included retail and e-commerce channels saw year-on-year increase of 39.2% in FY20.

In 1Q FY21, CROX expects sales to grow between 40% and 50% year-on-year and its adjusted operating margin to be between 17% and 18%. For FY21, the company sees revenues growing at a rate of between 20% to 25%. (See Crocs stock analysis on TipRanks)

On Feb. 19, Pivotal Research analyst Mitch Kummetz raised the stock’s price target from $87 to $92 and reiterated a Buy rating. Kummetz said, “2Q is CROX’s easiest comparison, but we wouldn’t be surprised if 1Q will be faster growing, as much of the spring order book will ship in 1Q, and 1Q appears to be off to a very strong start through the first half of the quarter.”

“For 2H, we suspect that CROX’s preliminary FY21 guidance does not assume much growth. First, it’s a difficult comparison. Second, when guidance was provided, CROX had limited visibility into its fall order book. That visibility has since improved, and we suspect that fall orders are coming in nicely, as channel inventory looks very lean and lined clogs have been a standout performer this winter,” the analyst added.

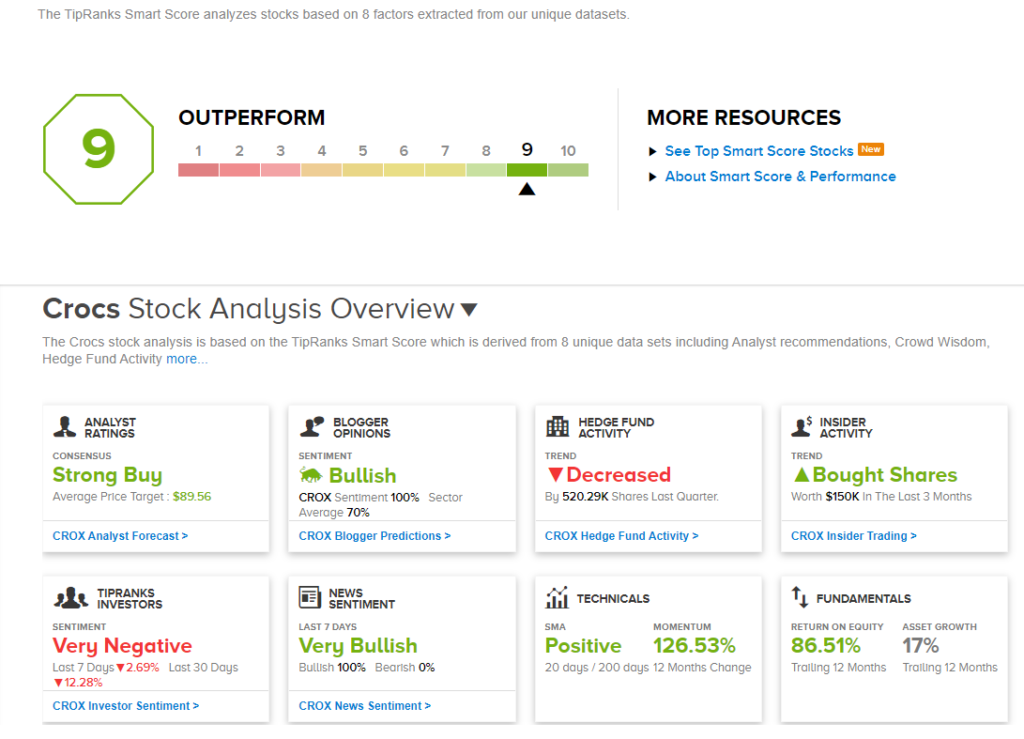

The rest of the Street is bullish on the stock with a Strong Buy consensus rating. That’s based on 8 Buys and 2 Holds. The average analyst price target of $89.56 implies 13% upside potential to current levels.

According to the TipRanks Smart Score system, Crocs scores a 9 out of 10 indicating that the stock is likely to outperform the market.

Related News:

ZoomInfo Spikes 12% As 4Q Profit Tops Analysts’ Estimates; Street Says Buy

PAVmed Tanks 12% After-Hours On Lucid Diagnostics Spin-Off

Five9 4Q Pops 10% Pre-Market On Blowout Quarter