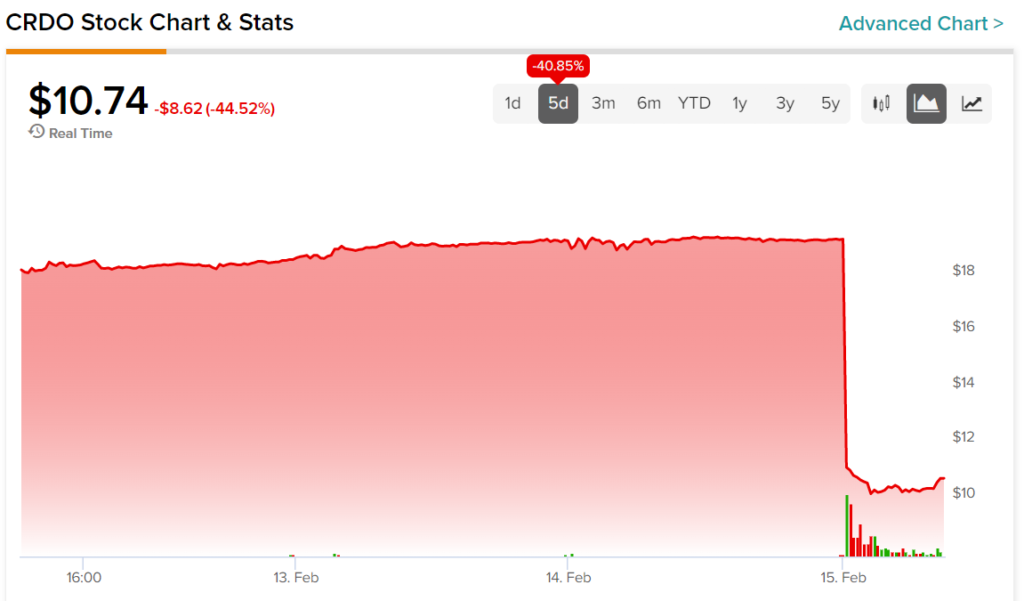

Shares of Credo Technology (NASDAQ: CRDO) collapsed in today’s trading session, which can be attributed to reduced demand from its largest customer. Unsurprisingly, this has had a material impact on the firm’s revenue guidance. Indeed, Credo now expects sales to come in at a range between $30 million to $32 million for its fourth quarter of Fiscal Year 2023. For reference, consensus estimates were expecting over $45 million.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

Credo stated that the reduction in demand was the result of macroeconomic headwinds as opposed to dissatisfaction with its services. However, this did little to please investors.

In fact, a look at the past five trading days shows the level of carnage that shareholders have had to endure, as CRDO stock has shed over 40% of its value.