Mass merchandisers, grocers and discount stores have been performing well amid the pandemic due to a shift in spending towards food and essentials as consumers are largely restricted to their homes. Also, a surge in e-commerce sales is benefiting several companies that have swiftly responded to consumers’ needs amid the pandemic and offered services like contactless delivery and curbside pick-up.

However, there are companies that have been performing quite consistently even when the impact of COVID-19-induced demand is ignored. We will pick two such companies, Costco and Dollar General, and use the TipRanks Stock Comparison tool to select the more attractive investment opportunity.

Costco Wholesale Corporation (COST)

Costco is a chain of membership-only warehouse clubs that operates 800 warehouses, including 556 in the US and Puerto Rico and the rest internationally. The company offers quality merchandise, including packaged food and sundries, hardlines (appliances and hardware), fresh foods, and softlines like apparel, at competitive prices. It also has ancillary businesses like gas stations, food courts and pharmacies.

The company mainly earns its profits through membership fees. As of the end of FY20 (ended Aug. 30), Costco had 58.1 million paid members, reflecting a 7.8% increase. Customer loyalty is reflected in the strong member renewal rate of 91% in the US and Canada and 88% worldwide. Costco’s revenue (including retail sales plus membership fees) grew 9.2% to $166.8 billion in FY20, driven by a 9.3% rise in net sales and a 5.6% rise in membership fees. Also, FY20 EPS grew 9.2% to $9.02.

Comparable sales rose 7.7% in FY20, backed by strength in food and sundries and fresh foods due to pandemic-fueled demand. However, the company’s gasoline business as well as optical, hearing aid and photo departments and food courts were hurt by pandemic-related restrictions.

Recently, Costco reported a 14.4% rise in its comparable sales for October (retail month ended Nov. 1), with e-commerce comps jumping 91.1%. Overall, October net sales grew 15.9% year-over-year to $13.8 billion. (See COST stock analysis on TipRanks)

Looking ahead, the company is strengthening its e-commerce capabilities. Costco’s e-commerce sales accounted for just 6% of the overall FY20 sales. The company acquired logistics company Innovel Solutions earlier this year for $1 billion to boost online sales of “big and bulky” merchandise like appliances and furniture.

Coming to store growth plans, Costco opened 16 new warehouses in FY20, including three relocations, and intends to open 23 warehouses in FY21.

On Nov. 16, Costco declared a special cash dividend of $10 per share, payable Dec. 11, 2020. This is Costco’s fourth special dividend in the past eight years. The aggregate payment of this special dividend will be about $4.4 billion. The company’s regular annual dividend of $2.80 implies a dividend yield of 0.74%

In reaction to the announcement, Oppenheimer analyst Rupesh Parikh said that the special dividend was in line with his expectations of $10-$15 and came a few months earlier than expected. He continues to rank Costco as his favorite holiday retail play and stated, “Even after this payout, more special dividends are likely on the horizon in coming years. We now expect the company’s ending cash balance at the end of FY22 (August 2022) to total more than $25 per share even after this upcoming distribution.”

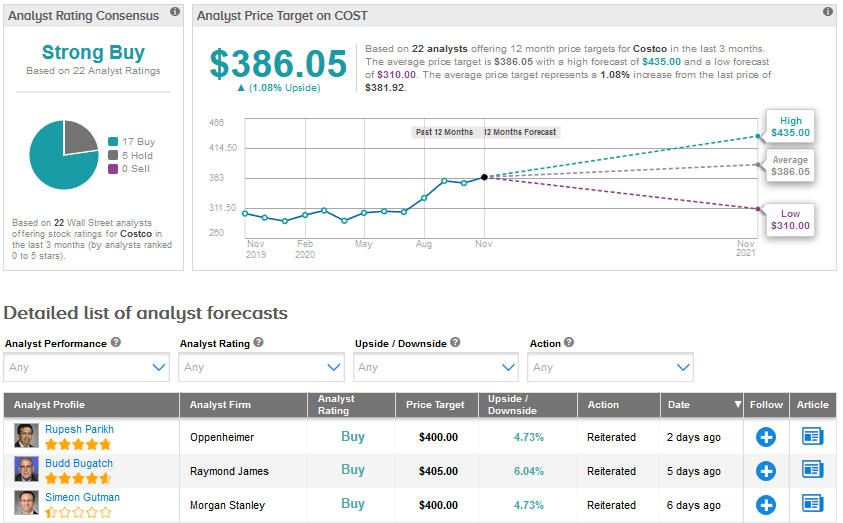

The Street is in line with Parikh’s bullish sentiment, with a Strong Buy analyst consensus based on 17 Buys versus 5 Holds. With shares advancing about 30% year-to-date, the average price target of $386.05 indicates a modest upside potential of 1.1% in the coming months.

Dollar General (DG)

Dollar General, which recently opened its 17,000th store, is one of the most consistent retailers. The COVID-induced demand for essentials further boosted the retailer’s performance in the recent months. Also, many of the company’s non-consumables categories performed well in the second quarter. Dollar General’s 2Q FY20 (ended Jul. 31) sales grew 24.4% year-over-year to $8.7 billion, driven by same-store sales growth of 18.8% and contribution from new stores.

Adjusted EPS exploded 79.3% year-over-year to $3.12 in 2Q FY20 as gross margin expanded 167 basis points to 32.5%, due to higher initial mark-ups on inventory purchases and increased sales of higher-margin non-consumables product categories. Also, the adjusted operating margin grew to 12% in 2Q FY20, compared to 8.72% in 2Q FY19 due to expense leverage on strong sales.

Meanwhile, Dollar General aims to open 1,000 new stores, remodel 1,670 stores and relocate 110 stores in FY20. It is also investing in additional cooler doors to drive higher on-shelf offerings of food items. Specifically, it aims to install over 60,000 cooler doors in FY20. The company’s growth strategy also includes a focus on private brands, better-for-you food offerings, DG Fresh (a multi-phase shift to self distribution of frozen and refrigerated goods) and expansion of product offerings in key non-consumables categories.

The company recently announced its latest retail store concept called ‘popshelf’, which will offer on-trend seasonal and home décor, health and beauty, home cleaning supplies, party goods and other merchandise, with about 95% of items priced at $5 or less. It is initially opening two new stores with this concept and plans to open 30 such locations by the end of FY21. The ‘popshelf’ concept is in line with the company’s initiative to enhance its non-consumables business. (See DG stock analysis on TipRanks)

Finally, Dollar General is also boosting its online sales by expanding facilities like DG Pickup, its buy online pickup in the store offering. It rolled out DG Pickup in over 2,500 stores in 2Q, with the aim of expanding to all stores by the end of 3Q.

On Nov. 12, Cleveland Research analyst Scott Bender said his checks indicate that sales growth slowed at Dollar General in September and October compared to the first few weeks of the quarter. The analyst stated that he does not believe the company saw the same back-to-school traffic boost that was seen in the mass channel. However, Bender maintained his above-consensus 3Q comps estimate of up 12% and a Buy rating.

Indeed, the Street also has a bullish outlook on Dollar General, with a Strong Buy analyst consensus that breaks down into 17 Buys and 2 Holds. Shares have rallied about 34% so far in 2020, and the average price target of $234.94 implies an upside potential of 12.6% in the months ahead. Meanwhile, Dollar General’s dividend yield stands at 0.68%.

Summary

Both Costco and Dollar General have a solid track record and are expected to perform well in the years ahead. However, Dollar General’s strong growth rates, lower valuation and a higher upside potential in the stock make it a better pick than Costco.

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment