Costco (NASDAQ:COST) reported year-over-year growth in total sales for June, while its total comparable sales slipped from the prior-year quarter. The weakness in the domestic market is believed to be the primary factor behind this decline. Following the news, COST stock dipped about 1% in yesterday’s extended trade.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

COST reported net sales of $22.86 billion for the five-week period ending July 2, 2023, reflecting a 0.4% increase compared to the same quarter of the previous year. However, during the month, comparable sales declined by 1.4%, with U.S. comparable sales down by 2.5%. Adjusting for gas sales and foreign exchange fluctuations, the company’s sales showed a 3% increase.

Based on the company’s monthly report, it is reasonable to conclude that the decline in gasoline prices is a major factor that led to lower sales. In the previous year, record-high gasoline prices had driven Costco’s topline growth. However, the situation changed in 2023, with lower gas prices impacting sales figures.

It is noteworthy that following the release of the monthly report, analyst Peter Benedict from Robert W. Baird maintained a Buy rating on COST stock. Moreover, his price target of $550 implies 2.35% upside potential.

Is COST a Buy or Sell?

Costco’s crackdown on membership card-sharing practices is anticipated to result in the growth of its member count, thereby supporting the company’s overall revenue growth. Additionally, the combination of value pricing and a growing customer base positions the retailer to attract higher foot traffic, even in a challenging macroeconomic environment.

With 18 Buy and five Hold recommendations, Costco stock sports a Strong Buy consensus rating on TipRanks. Analysts’ average price target of $559.80 implies 4.17% upside potential from current levels.

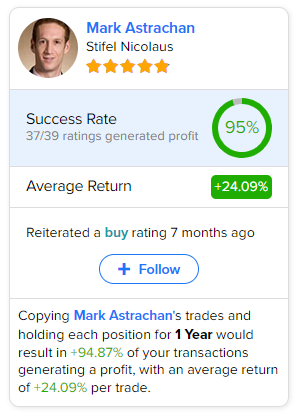

Investors looking for COST’s most accurate and profitable analyst could follow Stifel Nicolaus analyst Mark Astrachan. Copying the analyst’s trades on this stock and holding each position for one year could result in 95% of your transactions generating a profit, with an average return of 24.09% per trade.