Shares of Sorrento Therapeutics (SRNE) have been on the backfoot for most of the year, retreating by 63% since the February peaks.

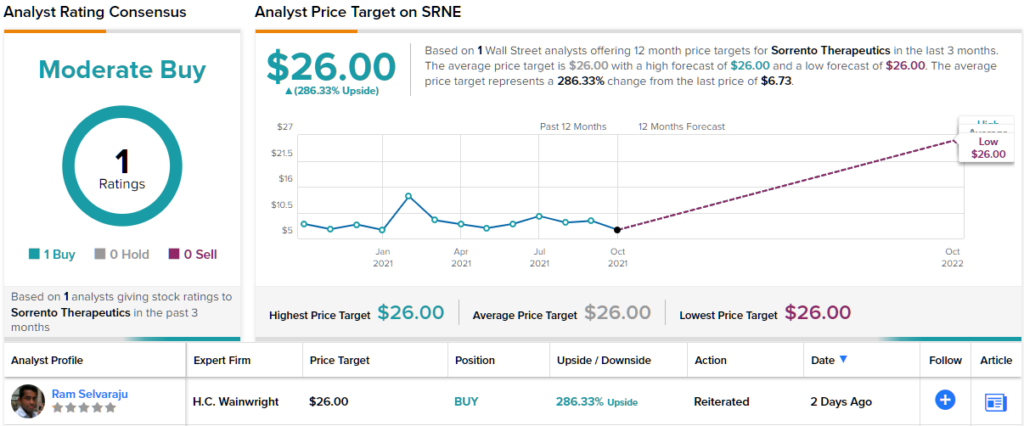

Throughout the downturn, however, one Street analyst has been backing the biotech; H.C. Wainwright’s Ram Selvaraju thinks the stock is poised to claw back those gains and some. The analyst reiterated a Buy rating on SRNE, along with a $26 price target. If correct, investors could be lining their pockets with a huge 286% gain. (To watch Selvaraju’s track record, click here)

Selvaraju’s latest endorsement follows a recent positive development. Last week, the company announced that COVISTIX, the company’s 15-minute diagnostic test for the detection of Covid-19, has received a CE mark and marketing authorization from FAMHP (Federal Agency for Medicines and Health Products). As many products need a CE marking before being given the go ahead in the EU, this opens the door for the test to enter the European markets.

The test has already been granted Emergency Use Authorization (EUA) by the regulatory body in Mexico, and EUA filings are afoot in the United States, Canada and Brazil as well as with the World Health Organization (WHO).

COVISTIX was shown to be highly accurate in a large independent study undertaken by INMEGEN (Instituto Nacional de Medicina Genomica, Mexico), boasting an 81% sensitivity rate compared to the 62% sensitivity rate exhibited by Panbio – the international leading rapid antigen test.

“This finding is significant as higher COVISTIX sensitivity means fewer false negatives, which is essential to managing the spread of COVID virus infection and preventing the COVID disease, in particular those cases linked to highly transmissible variants of concern such as the Delta variant,” Selvaraju noted.

Although the analyst anticipates Sorrento’s diagnostics offerings will generate “substantial revenue,” Selvaraju reminds investors that his valuation assessment “does not factor in any contribution” from Sorrento’s Covid-19 therapeutics pipeline. These could drive “meaningful upside” to Selvaraju’s forecasts.

The company is currently running several studies testing Covid-19 solutions. These include “multiple” Phase 2 trials in the U.S. and U.K. for COVIDROPS, Sorrento’s intranasal formulation of neutralizing antibody COVI-AMG. Sorrento intends to apply for Emergency Use Authorization (EUA) in several countries, should results prove positive.

There is also COVI-MSC, a proprietary preparation of mesenchymal stem cells (MSCs), earmarked to begin a randomized, controlled clinical study. This drug could also “qualify” for an EUA before the end of the year, dependent on a positive outcome in the study. COVI-MSC is also undergoing Phase 2 testing in Brazil, for which patient enrollment began last month. The coming months should also see the release of top-line data from two Phase 2 trials of abivertinib, a Bruton’s tyrosine kinase (Btk) inhibitor being assessed for the treatment of hospitalized COVID-19-infected patients.

Despite the positive developments and upcoming catalysts, Sorrento appears to be flying under the Street’s radar. Selvaraju’s is the only recent analyst review on record here. (See Sorrento stock analysis on TipRanks)

To find good ideas for biotech stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.