Shares of Qiagen rose as much as 4% in Wednesday’s extended market session after the medical diagnostics company said it has started to sell its portable digital Covid-19 test in the US.

Qiagen (QGEN) said it has rolled out the marketing and distribution of its QIAreach SARS-CoV-2 antigen test in the US after applying for FDA emergency use authorization (EUA) for symptomatic patients. The mass screening test, developed in partnership with Australian digital diagnostics company Ellume, can be used by laboratories to detect SARS-CoV-2 antigens in infected individuals within 2-15 minutes. The portable digital device can process and analyze over 30 samples per hour and will be particularly valuable when vaccines are introduced, the company added.

“As existing approaches often lack scalability and accuracy, antigen testing is playing an increasingly important role in national testing strategies as a complementary tool to PCR, the gold-standard for detecting active COVID-19 infections,” said Qiagen CEO Thierry Bernard. “QIAreach SARS-CoV Antigen is a fast, digital and easy to use test that makes use of sensitive nanoparticle technology from Ellume. It addresses the growing need for higher throughput testing for SARS-CoV-2 antigen by processing up to eight tests per hub simultaneously.”

Testing of clinical samples have demonstrated that the QIAreach antigen test has a sensitivity of 90% and a specificity of 100%, Qiagen said. The company said it expects the test to be submitted for CE-IVD registration for European Union regulatory approval as well as for other markets by the end of the year.

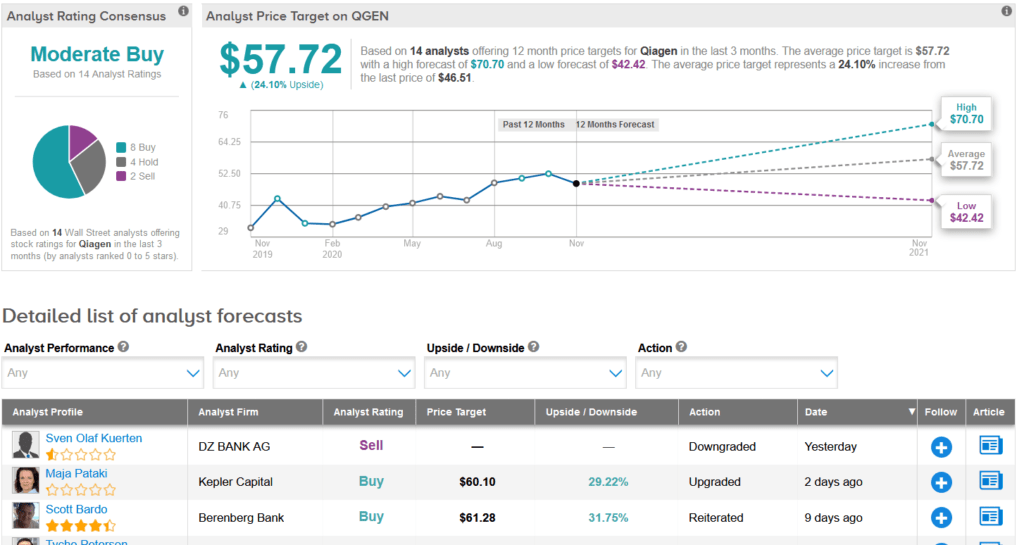

Qiagen shares have dropped 15% over the past month but are still up 37% so far this year with the average of analysts cautiously optimistic on the stock with a Moderate Buy consensus. Looking ahead, the average analyst price target stands at $57.72, implying a promising 24% upside potential is lying ahead over the coming year.

Merrill Lynch analyst Derik De Bruin recently reinitiated the stock’s coverage with a Buy rating and a price target of $59, amid optimism that Qiagen’s new products may be accelerated by COVID-19. The analyst cautioned though that execution risks do remain.

“With a new CEO in place and new products in the portfolio, QGEN has the opportunity to reinvent itself, especially when it comes to deploying capital, further reducing the cost structure, and delivering on expectations,” De Bruin commented in a note to investors. (See QGEN stock analysis on TipRanks)

Related News:

Moderna On Cusp Of Covid-19 Vaccine Data Release; Shares Pop 8%

Pfizer, BioNTech Announce COVID-19 Vaccine is 90% Effective

Ocular Therapeutix Rises 7% On Stellar Results Backed By Dextenza