It’s official, a new Covid-19 vaccine candidate has entered the fray.

On Tuesday, Ocugen (OCGN) announced it had finalized its deal with India-based Bharat Biotech. The two will work together on COVAXIN, Bharat’s Covid-19 vaccine, for the U.S. market.

Ocugen will take on all aspects of U.S. based responsibilities, including clinical development, regulatory approval, and commercialization. If the vaccine is granted an EUA, Bharat anticipates supplying the U.S. market’s initial COVAXIN doses.

Bharat, in return, will be eligible for 55% of U.S. sales’ profits, with Ocugen retaining the other 45%.

Ocugen gets a head start, as COVAXIN has already been granted emergency use authorization in India. It is also currently in a Phase 3 study with 25,800 subjects enrolled.

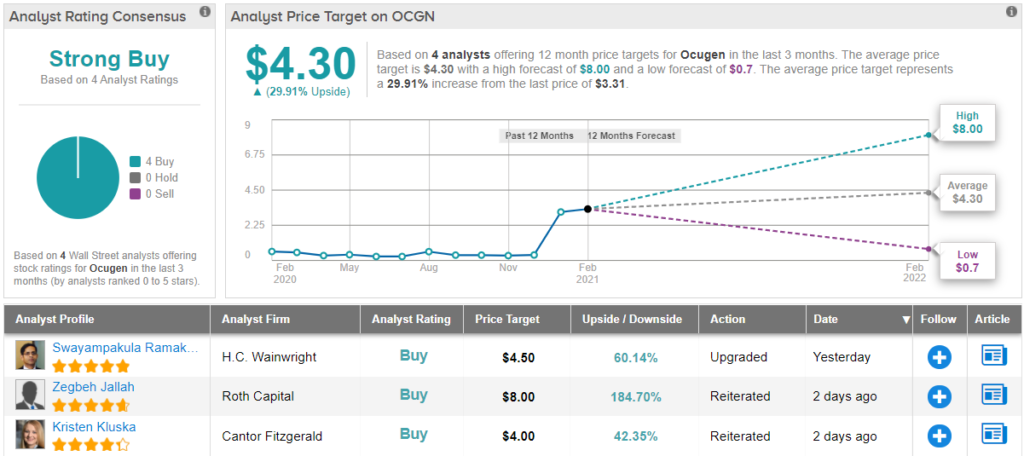

H.C. Wainwright analyst Swayampakula Ramakanth says the vaccine has qualities which set it apart from the competition.

“Compared to COVID-19 vaccines currently authorized under EUA, COVAXIN could induce more broad immunity targeting multiple viral proteins, potentially resulting in better protection against emerging mutant viruses, such as the UK and South African variants,” the 5-star analyst noted. “Additionally, COVAXIN only requires a standard vaccine storage temperature, compared to the more stringent storage requirements for the mRNA vaccines.”

The vaccine, therefore, “could strengthen the arsenal to fight against the pandemic.”

Ocugen is already in talks with the FDA and the Biomedical Advanced Research and Development Authority (BARDA) to map out the path forward to “a successful EUA.”

Given the dire need for Covid-19 vaccines, Ramakanth believes that should the Indian Phase 3 study display more than a 50% success rate, there’s a possibility the FDA could make an “unprecedented move” and grant COVAXIN EUA status.

“Therefore,” the analyst summed up, “We believe COVAXIN has the potential to deliver significant upside in the next 6-12 months.”

As a result, Ramakanth upgraded Ocugen’s rating from Neutral (i.e. Hold) to Buy with a $4.5 price target. The implication for investors? Upside of 60% for the coming year. (To watch Ramakanth’s track record, click here)

Ramakanth’s colleagues back up his call, as all 3 other recent Ocugen reviews say Buy. OCGH’s Strong Buy consensus rating is backed by a $4.30 average price target, suggesting a ~30% premium will be added to the shares in the year ahead. (See OCGN stock analysis on TipRanks)

To find good ideas for healthcare stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.