Shares of vaccine researcher Inovio Pharmaceuticals (INO) are currently trading around the $15 level, and one analyst thinks that’s a bargain.

Oppenheimer analyst Hartaj Singh makes the argument that progress on Inovio’s INO-4800 coronavirus vaccine, combined with its INO-5401 cancer vaccine and its Human papillomavirus (HPV) vaccine VGX-3100, could drive Inovio stock higher. How much higher?

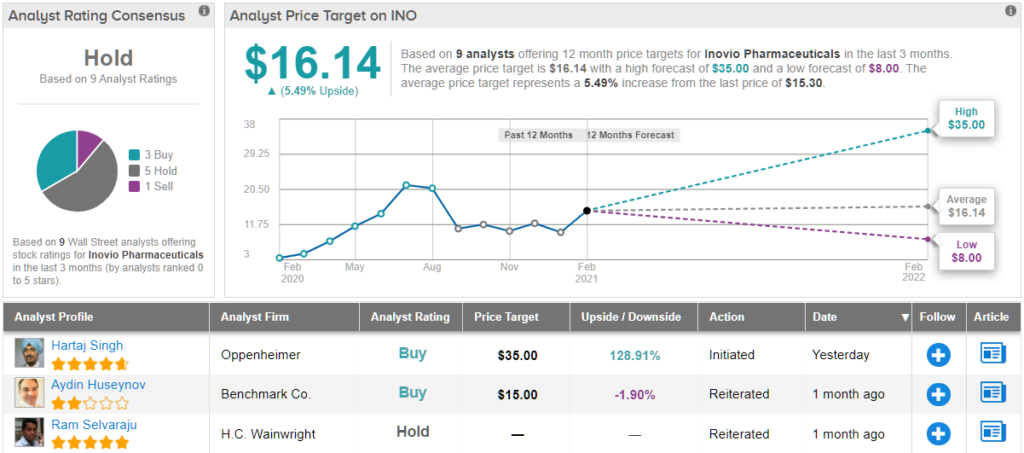

Singh initiated coverage on INO with an Outperform (i.e. Buy) rating and set a Street high price target of $35. Should the target be met, investors could pocket gains of 128% over the next 12 months. (To watch Singh’s track record, click here)

Of the three biggest vaccine candidates, Singh sees INO-4800 as the one offering the most immediate value, and contributing $20 per share to his $35 overall target price.

Less well known than competing coronavirus vaccines from Pfizer or Moderna, Singh notes that INO-4800 has several advantages to recommend it. For one, it’s DNA-based, and thus can theoretically be modified to combat mutated versions of the COVID-19 coronavirus. For another, it offers a better “safety/tolerability profile,” that could recommend it as an alternative to other vaccines. And for a third, INO-4800 is said to be both easier to store and has a longer shelf life than other vaccines on the market today, which might make it more suitable for stockpiling against future coronavirus outbreaks.

VGX-3100 is the next most valuable of Inovio’s vaccine candidates, thinks Singh, being worth perhaps $7 a share. It’s also, says the analyst, the vaccine with the “highest sustainability and potential upside on commercialization” for Inovio, as HPV will presumably remain a problem long after the coronavirus pandemic has gone away. Singh also sees “potential to expand into other (pre)cancerous indications” based on research done for VGX-3100.

Finally, Singh sees INO-5401 as worth perhaps $5 a share to Inovio stock. In the analyst’s view, INO-5401 could be a “potential breakthrough” drug for treating patients with glioblastoma, a cancer that has not seen a real improvement in treatment options “for decades.”

Other vaccine candidates in the pipeline, plus Inovio’s cash on hand, make up the final $3 of the analyst’s target valuation for Inovio.

Not all this value may be immediately apparent to investors, however. Notably, Singh admits that revenues at Inovio over the past three years have been measured in the low single digits of millions of dollars. It won’t be until next year, says the analyst before sales really grow appreciably. But once these vaccines begin coming to market, the analyst sees significant growth potential: $656 million in sales in 2022, twice that in 2023, $2.1 billion in 2024, and $3 billion in 2025.

Indeed, by 2025, the analyst forecasts that Inovio could be earning $6.48 per share, per year, making today’s price target of $35 (not to mention today’s actual share price of $15) look cheap indeed. And indeed, that’s probably why the analyst is rating the stock “outperform” and recommending that investors buy it.

In the meantime, though, investors will need to be patient, because Singh sees no chance of Inovio earning anything this year. Profits will only emerge alongside sales next year — $1.46 per share.

Granted, not everyone is as enthusiastic about INO as the Oppenheimer analyst. INO’s Hold consensus rating is based on 3 Buys, 5 Holds and a single Sell. INO shares have had a bountiful 2021 so far, and are up ~72%. As such, the $16.14 average price target suggests limited upside potential. (See INO stock analysis on TipRanks)

To find good ideas for healthcare stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.