Shares in IMV Inc. (IMV) are spiking 134% in Tuesday’s pre-market trading after the clinical-stage biopharma company said it made “rapid progress” in developing its candidate vaccine to prevent COVID-19 infection.

The stock surged to $4 in pre-market trading as IMV said that it was working closely with regulatory agencies and its partners to initiate clinical studies as quickly as possible. The plan for the Phase 1 clinical study, agreed with Health Canada, is a randomized controlled study, assessing the safety and immunogenicity of its vaccine candidate DPX-COVID-19, to be conducted in 84 healthy adults across two age cohorts.

DPX-COVID-19, is based on the Canadian biotech’s first-in-class lipid-based vaccine delivery platform that generates targeted and sustained immune response in vivo. Fully synthetic, the vaccine candidate is designed to focus the immune response on the weaknesses of the virus with the goal to optimize safety and efficacy.

“The rapid progress in target selection, the vaccine formulation, manufacturing and preclinical results so far not only demonstrate the potential of our delivery platform, but also build on our previously reported clinical data from a similarly designed vaccine against RSV, the respiratory syncytial virus,” says IMV CEO Frederic Ors. “Clinical results have shown our DPX-based vaccine against RSV demonstrated a unique ability to generate safe and long-lasting immune responses in older adults.”

IMV, a pioneer in a novel class of cancer immunotherapies and vaccines against infectious diseases, said it expects to start first in-human Phase 1 clinical trials this summer with results due in the fall of this year. Once results are published, the biotech company plans to initiate Phase 2 clinical trials in the second half of the year.

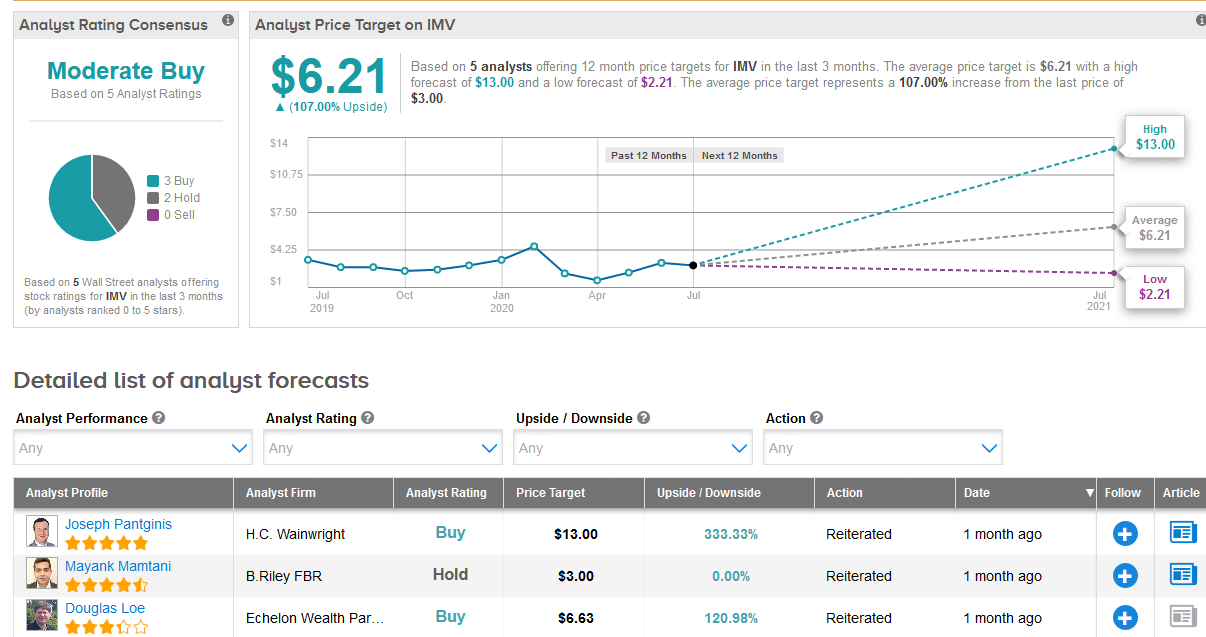

Shares in IMV have more than doubled since hitting a low in March and are now trading 2.8% higher than at the beginning of the year. Overall, Wall Street analysts have a cautiously optimistic outlook on the stock with a Moderate Buy consensus. Despite the recent rally, the $6.21 average analyst price target implies a whopping 107% upside potential to current levels. (See IMV stock analysis on TipRanks)

Related News:

Abbott Labs, Edwards Lifesciences Settle Heart Device Patent Disputes

Aldeyra Spikes 10% In Pre-Market On New Perceptive Stake

Equillium Explodes 260% On Positive Covid-19 Results; India Approval