Gilead Sciences Inc.’s (GILD) remdesivir, its coronavirus drug candidate, is most “beneficial” for Covid-19 patients who require supplemental oxygen but don’t need mechanical ventilation, according to a study by the National Institute of Allergy and Infectious Diseases (NIAID).

“Ultimately, the findings support remdesivir as the standard therapy for patients hospitalized with Covid-19 and requiring supplemental oxygen therapy,” the report said, citing preliminary results from the randomized, controlled trial, published in The New England Journal of Medicine.

Over a 10-day course, patients received the antiviral remdesivir intravenously and a placebo. The report showed that patients who received remdesivir had a shorter time to recovery than those who received placebo. The median time to recovery was 11 days for patients treated with remdesivir compared with 15 days for those who received placebo.

“These findings support the use of remdesivir in this population, with the largest benefit observed among individuals who required oxygen supplementation but were not mechanically ventilated,” said Merdad Parsey, Chief Medical Officer, at Gilead Sciences.

Parsey added that Gilead expects results from its Phase 3 SIMPLE-Severe study, which is evaluating experimental remdesivir in a similar population of Covid-19 patients, to be published in the “near future”.

At the end of this month, Gilead expects to receive results from its Phase 3 SIMPLE-Moderate study, which is evaluating remdesivir in hospitalized patients with Covid-19 and lung involvement not requiring oxygen supplementation.

“Beyond the ongoing studies of remdesivir, we look forward to the initiation of combination studies of remdesivir to understand whether the addition of other drugs may enhance patient outcomes,” Parsey said.

Shares in Gilead dropped 13% so far this month after gaining 29% in the January to April period.

Following talks with Gilead’s management on May 18, five-star analyst Hartaj Singh at Oppenheimer said he remained bullish on the stock by maintaining a Buy rating with a $90 price target (23% upside to current level).

“A potential inhaled (nebulized) version of remdesivir (data 2H20) could increase remdesivir availability by a factor of 3x to 4x (vs. current),” Singh wrote in a note to investors.

According to the analyst, management was also preparing a business case for remdesivir potentially updating investors over the next few weeks.

“While we believe the GILD P&L is building sales/earnings momentum, the budding pipeline story is starting to catch our eye,” Singh wrote. “We believe GILD remains steadfast in bringing life-altering medicines to market. With a 4% dividend yield, $2.5 to $3B in FCF/quarter, and non-GAAP operating margins of >50%, we see a company positioned for success, in spite of the current investor pessimism.”

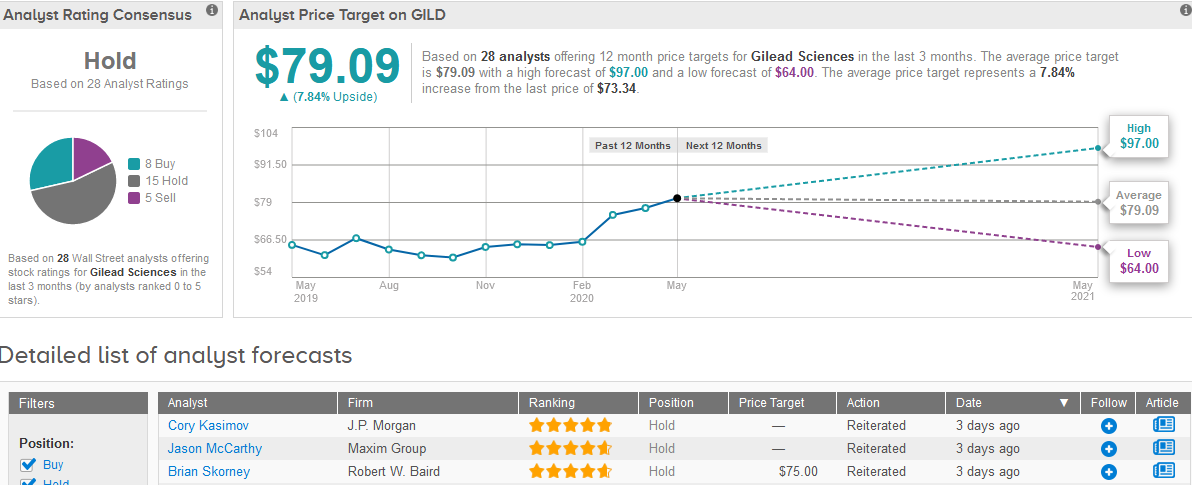

TipRanks data shows that the majority of 15 analysts have a Hold rating on the stock, while the rest are divided between 8 Buys and 5 Sells, adding up to a Hold consensus. The $79.09 average price target is less optimistic than Singh’s as it indicates a mere 7.8% upside potential in the shares in the coming 12 months. (See Gilead stock analysis on TipRanks)

Related News:

Gilead and Galapagos Score Positive Topline Results For Ulcerative Colitis Trial

Moderna Spikes 21% Amid “Positive” Early-Stage Covid-19 Vaccine Data

AstraZeneca-Merck Lynparza Prostate Cancer Treatment Gets FDA Approval