Core-Mark Holding Company (CORE), a provider of food and broad-line supply solutions will be acquired by Performance Food Group Company (PFGC) in a cash-and-stock deal valued at $2.5 billion. Performance Food Group is a food service distribution company.

Shares of PFGC were down 6.2% while CORE shares jumped 6.9% in pre-market trading on Wednesday.

According to the terms of the transaction, CORE shareholders will receive $23.875 for each share in cash and 0.44 PFG shares for every CORE share. The acquisition is expected to close in the first half of next year and upon closing, shareholders of Core-Mark will own 13% of the combined company.

Core-Mark’s President and CEO, Scott McPherson said, “This transaction brings together two companies known for their customer-focused approach and dedication to their employees…our Board evaluated the transaction and determined this combination provides our investors immediate value and the opportunity to participate in the upside potential of being part of a larger, diversified and customer-centric supplier in the foodservice and convenience retail industry.”

“The combination of our two highly complementary businesses creates an even stronger platform to drive growth, as we deliver a best-in-class offering to our customers. I’d like to thank the entire Core-Mark team for their hard work and focus in helping us reach this exciting milestone,” McPherson added.

The acquisition is expected to expand PFGC’s market diversification and geographic footprint when it comes to the convenience store channel and is expected to add $17 billion to net sales and a total of pro-forma last twelve months (LTM) net sales of $44 billion.

The transaction is expected to be accretive to adjusted diluted earnings per share (EPS) in the first fiscal year after the close of the acquisition, excluding cost synergies. It will also expand PFGC’s customer base and product offerings.

The acquisition is anticipated to generate $40 million in annual cost synergies by the third year after the closing of the transaction and will create a convenience business that will be a part of PFGC’s Vistar segment and will include CORE and Eby-Brown businesses. The convenience business will operate under the Core-Mark brand and its headquarters will be located at Westlake, Texas. (See Core-Mark Holding Company stock analysis on TipRanks)

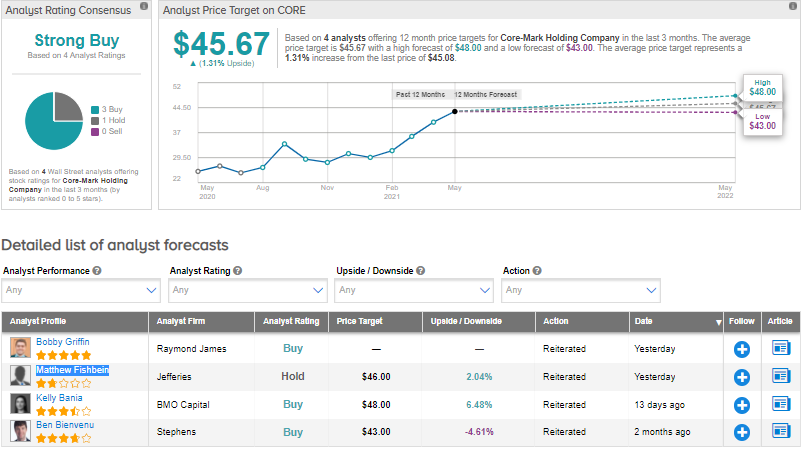

Following the acquisition announcement, Jeffries analyst Matthew Fishbein raised the price target from $41 to $46 and reiterated a Hold on the stock. Fishbein commented on the acquisition, “Although the transaction’s implied forward pre-synergy EBITDA multiple is ~11.5x vs. CORE’s ~10x historical average, CORE’s EBITDA growth outlook could see pressure from a normalization of delivery drop rates relative to pre-pandemic frequency, and the absence of CORE’s own M&A (a key historical growth lever).”

“The deal would also accelerate CORE’s ongoing product diversification away from tobacco and towards the Food and Fresh categories. We believe PFGC and CORE likely have high visibility on each of the components outlined with PFGC’s $40M cost synergy target given the more mechanical nature of logistics optimization, distribution center consolidation, and more favorable supplier contract renewals over time,” Fishbein added.

Overall, consensus among analysts is that CORE is a Strong Buy based on 3 Buys and 1 Hold. The average analyst price target of $45.67 implies that shares are almost fully priced at current levels.

Related News:

Amazon Could Acquire MGM Studios For $9B – Report

Beyond Meat Partners with Yum Brands’ Pizza Hut in Canada

AT&T Merging Its WarnerMedia Unit with Discovery in $43B Deal