The volatility in the stock market and uncertain economic trajectory make investments challenging for retail investors. Thus, following ace investors like Ray Dalio, the founder of Bridgewater Associates (one of the most significant hedge funds), makes sense for retail investors. Bridgewater’s recently filed 13F report shows that the investment market legend has allocated big bucks in Visa (NYSE:V), Mondelez (NASDAQ:MDLZ), Microsoft (NASDAQ:MSFT), Thermo Fisher (NYSE:TMO), and Alphabet (NASDAQ:GOOGL).

The table below summarizes Bridgewater Associates’ transactions in the above five stocks in Q3.

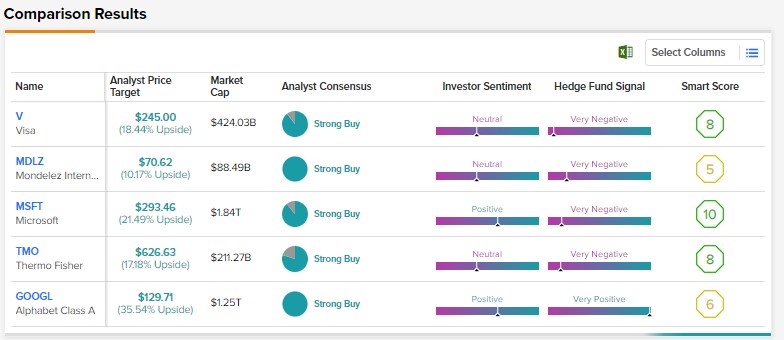

Using TipRanks’ database, we found that these five stocks are compelling investments. According to our platform, the analyst community is bullish on these stocks, and they sport a “Strong Buy” consensus rating on TipRanks.

While analysts are bullish on these large-cap companies, TipRanks’ Stock Comparison tool shows that Visa, Microsoft, and Thermo Fisher have an Outperform Smart Score of eight or above. Meanwhile, Mondelez and Alphabet stocks carry a Neutral Smart Score on TipRanks.

A Closer Look at Dalio’s Q3 Portfolio Reshuffle

Dalio’s Q3 portfolio reshuffle highlights the changing stock market scenario.

Microsoft and Alphabet

Despite the uncertainty, easing inflation paves the way for a slowdown in the interest rate hike, propelling shares of fundamentally strong large tech companies like Microsoft and Alphabet.

Visa

As for Visa, the company’s steady financial performance despite macro and geopolitical headwinds is positive. Further, an increase in cross-border payment volumes and expected growth in consumer spending amid the Holiday season should support the upside in Visa’s stock.

Robert W. Baird analyst David Koning, who is bullish on Visa stock, said, “We like the stock a lot as the company is faring well in the current macro environment.” Koning added, “We like the concept that many other companies have already had earnings recoveries, while Visa not only has the likelihood of above-normal revenue growth over the next 2-3 years, but a growth profile that is strong even without any extra juice.”

Thermo Fisher Scientific

Further, for Thermo Fisher Scientific, its solid organic sales (increased by 14% in Q3) and diversified portfolio support the bull case.

Robert W. Baird analyst Catherine Ramsey Schulte, who recommends a Buy on TMO stock, expects the company to benefit from its “diversified portfolio exposure and execution track record heading into next year.”

The analyst is upbeat about TMO’s organic sales, its focus on accretive acquisitions, and its attractive financial profile. (Learn more about TMO’s financials here.) Schulte also highlighted that TMO stock is trading at the next 12-month price-to-earnings (P/E) multiple of 22.5x, which is within the two-year historical average range of 20x-28x.

Mondelez

Coming to Mondelez, the food giant continues to benefit from its ability to drive volumes and pricing that support its organic sales. Jefferies analyst Robert Dickerson rates MDLZ stock a Buy. He expects the company to benefit from its strong foothold in “faster-growth snacking categories with exposure to faster-growth markets relative to many of its US peers.”

The analyst expects near-term sales and margins to take a hit from currency and cost headwinds. However, he recommends “the name given longer-term top-line potential, pricing ability, and cost offsets relative to peers, allowing for relatively stable FCF generation.”

Dalio’s Other Key Moves in Q3

Dalio’s Bridgewater Associates opened a new position in 62 stocks in Q3, including Accenture (NYSE:ACN), Antero Resources (NYSE:AR), and Honeywell International (NASDAQ:HON). ACN and AR stock sport a Strong Buy consensus rating on TipRanks. Meanwhile, HON stock has a Moderate Buy consensus rating.

Dalio closed his position in 181 companies in Q3, including Intel Corporation (NASDAQ:INTC). The chipmaker has disappointed this year and eroded investors’ wealth.

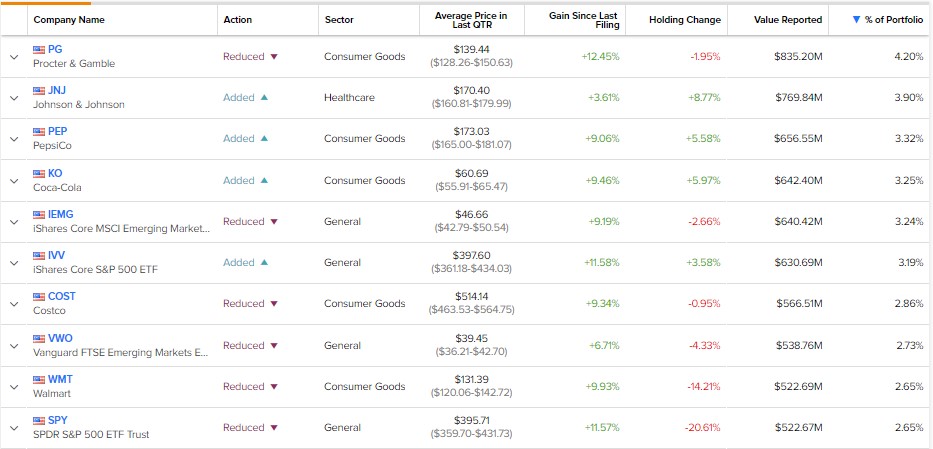

Including the recent reshuffles, below are the top 10 holdings of Bridgewater Associates.

Bottom Line

Dalio’s aggressive investments in V, MDLZ, MSFT, TMO, and GOOGL stocks and analysts’ positive outlook indicate that these companies are set to deliver strong returns. Meanwhile, Visa, Microsoft, and Thermo Fisher stocks have a Smart Score of eight or above, implying that these three stocks are more likely to outperform the benchmark index.

Find out which stock the biggest hedge fund managers are buying right now.