American branded food company Conagra Brands, Inc. (CAG) reported better-than-expected first-quarter results despite inflationary pressures. Strong momentum and demand for its products coupled with comprehensive actions taken by the company have helped it to sustain during the quarter. Shares closed at $34.22 on October 7.

The company reported adjusted earnings of $0.50 per share, down 28.6% year-over-year, and marginally beat analysts’ estimates of $0.49 per share.

Furthermore, net sales fell 1% year-over-year to $2.65 billion but surpassed the Street’s estimate of $2.52 billion. (See Conagra Brands stock charts on TipRanks)

Commenting on the quarterly results, Sean Connolly, President, and CEO of Conagra said, “We believe that our disciplined approach to investment and sustained focus on strategic innovation will help us maintain brand momentum. We remain confident in the long-term potential of each of our domains – frozen, snacks, and staples – and in our ability to continue creating sustained value for our shareholders.”

Based on stronger than expected consumer demand and lower than anticipated demand elasticities and planned pricing actions, the company has raised its organic net sales growth guidance to 1%+ for FY22.

Additionally, for the full year of Fiscal 2022, the company reaffirmed its guidance for adjusted earningsof approximately $2.50 per share. Also, Conagra revised its gross inflation expectations upwards to around 11% for FY22.

In response to Conagra’s Q1 performance, Jefferies analyst Robert Dickerson maintained a Buy rating on the stock with a price target of $40, implying 16.9% upside potential to current levels.

Dickerson was impressed by the slight beat and raise quarter delivered by CAG and said, “Demand/elasticities encouraging to offset incremental costs; buyback activity continues. Expect stock up a bit today.”

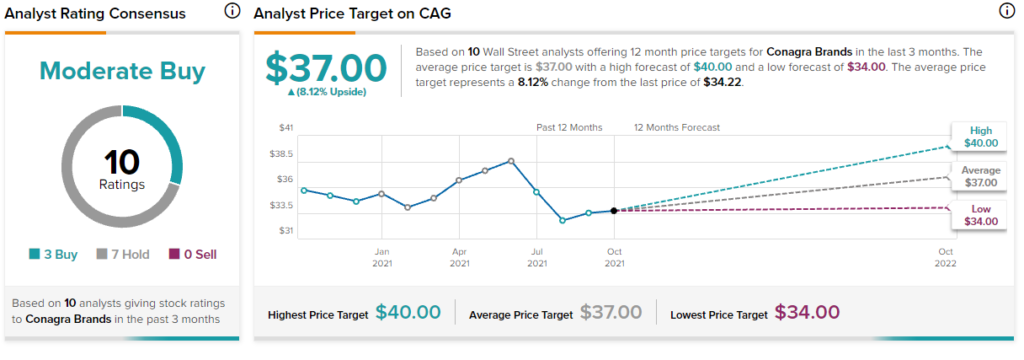

Overall, the stock has a Moderate Buy consensus rating based on 3 Buys and 7 Holds. The average Conagra Brands price target of $37 implies 8.1% upside potential to current levels. Shares have lost 8.1% over the past year.

Related News:

Tesla Hikes Prices of Model 3 and Model Y

Levi’s Beats Q3 Expectations; Shares Pop After-Hours

Paychex Acquires Flock to Drive Innovation