Gas, steam, and electric services provider consolidated Edison (NYSE:ED) is selling its renewable energy subsidiaries to RWE Renewables Americas in a transaction pegged at $6.8 billion.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

This includes Con Edison Clean Energy Businesses Inc. and its subsidiaries. The deal is expected to close in H1 2023. Concurrently, Con Edison has withdrawn its plan to issue about $850 million in equity in 2022 and has also withdrawn its outlook for 2023 and 2024.

The move allows the company to focus on its core utility businesses.

Is ED a Good Buy?

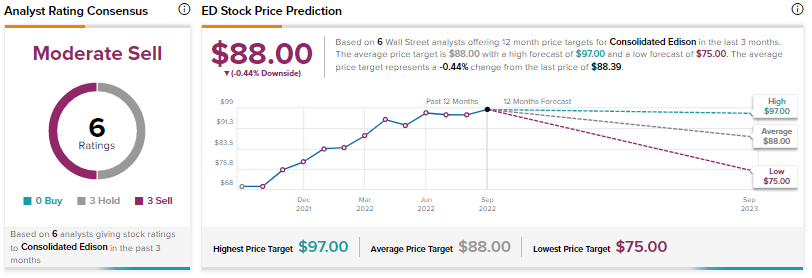

Despite the recent decline, ED shares are still up ~21% over the past year and the $88 average price target for the stock indicates it is fairly priced at current levels.

The consensus rating for the stock remains a Moderate Sell based on three Holds and Sells each for the stock at present.

Read full Disclosure