The world’s largest coffee chain, Starbucks Corporation (NYSE: SBUX), is crippled by the doubling effect of heightened competition in the U.K. and crime rates in certain parts of the U.S. Additionally, the inflationary environment poses a risk to its premium coffee offerings.

Starbucks Contemplates Selling its UK Business

According to a Times report, the coffee chain is contemplating selling its UK business as it faces increased competition from domestic brands, namely Pret A Manger, Tim Hortons, and Costa Coffee. Additionally, the rising costs of input materials are also driving down margins, further worsening the case.

Although Starbucks has not initiated a formal sale process, it is believed that the coffee maker has asked its advisor, Houlihan Lokey, to look for interested parties. Starbucks’ UK business includes more than 1,000 coffee shops with around 4,000 employees. Out of these, 300 are company-operated and the rest are licensed.

Safety Concerns Force Starbucks to Shut Stores

According to a CNBC report, Starbucks has decided to shut 16 stores on the West Coast due to safety concerns for its employees. A total of six stores will be shuttered in the Greater Los Angeles area; six in the Greater Seattle area; two in Portland, Oregon; and one each in Philadelphia and D.C.

Crimes such as car theft, larceny theft, burglary, and violent robbery have surged in these areas in 2022. The company made the difficult decision to shut the stores in these specific areas and emphasized the need for “creating a safe, welcoming, and kind third place” as a top priority.

A letter to partners read, “You’re also seeing firsthand the challenges facing our communities—personal safety, racism, lack of access to healthcare, a growing mental health crisis, rising drug use, and more. With stores in thousands of communities across the country, we know these challenges can, at times, play out within our stores too.”

Analysts Are Cautiously Optimistic about SBUX

Ahead of the company’s quarterly results, Deutsche Bank analyst Brian Mullan cut the price target on SBUX stock to $91 (14.3% upside potential) from $103 and maintained a Buy rating. The company is slated to report its Q3 earnings on August 2, with the consensus estimate for earnings per share (EPS) pegged at $0.77.

Overall, SBUX stock has a Moderate Buy consensus rating based on 11 Buys and nine Holds. The average Starbucks price target of $90.80 implies 14% upside potential to current levels. Meanwhile, the stock has lost 30.9% year to date.

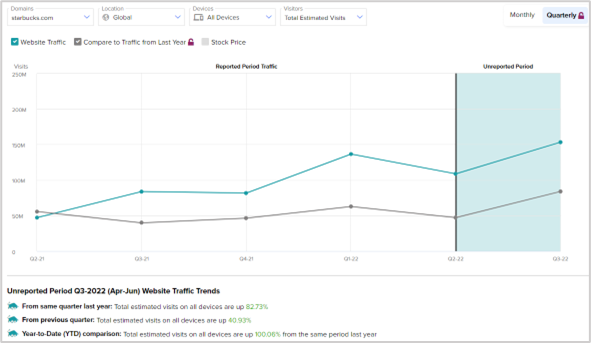

Starbucks Website Traffic Sees Growth

According to the TipRanks Website Traffic Tool, in Q3, Starbucks website traffic recorded a massive 82.73% year-over-year increase in estimated global visits across all its devices. Similarly, year-to-date website traffic growth doubled to 100.06% compared to the same period last year.

The company even witnessed a sequential growth of 40.93% in total estimated website visits. The month of June alone contributed a robust growth of 188.04% compared to June of 2021.

Parting Thoughts

The website traffic trends display a strong quarter for the coffee maker. We’ll have to wait and watch whether the inflationary environment has indeed hurt its sales, or whether its results outperform based on the robust trend witnessed in the website traffic.

Learn how Website Traffic can help you research your favorite stocks.