Cloud software and backup systems provider CommVault (NASDAQ:CVLT) plunged today after releasing its preliminary figures for third-quarter earnings. The official earnings call won’t come out until later this month. However, today’s info was sufficient to send the stock spiraling down.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

CommVault announced that its third-quarter revenues were $195.1 million. That’s down 4% against this time last year. However, not all of that is CommVault’s fault; currency issues got in the way and dragged the company down. If currency had remained constant, revenue would have actually grown by 1%. The company lost 9% in software and products revenue, and software and products revenue just for the Americas region was down 20%.

Here again, both sets of losses would have been ameliorated had currency values remained the same, but since currency values fluctuated so substantially, the losses hit harder. Reports noted a diluted loss per share of $0.01. That’s a long way off analysts’ projections that called for earnings of $0.68 per share.

CommVault president and CEO Sanjay Mirchandani offered some comments on what happened. The biggest problem for CommVault was macroeconomic. Customers were slow to buy and quick to cancel orders, particularly when it came to new technologies. Mirchandani closed his remarks with hopeful tones, noting that CommVault believes in its strategy and will work around the macroeconomic changes to come accordingly.

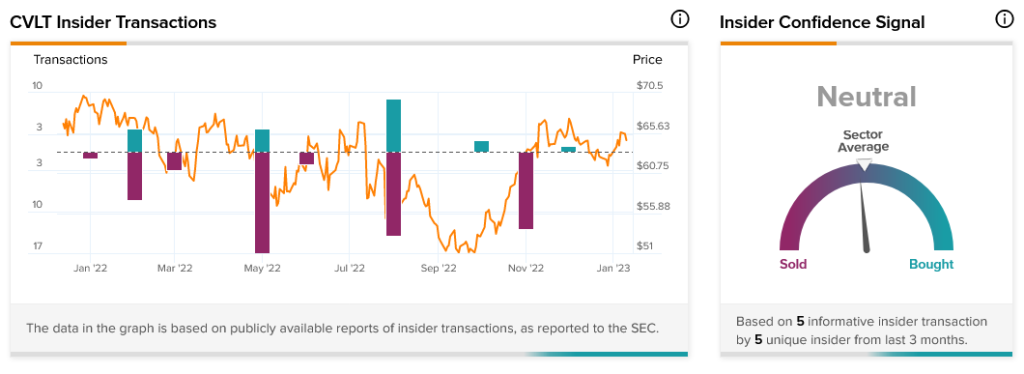

Insiders, meanwhile, don’t seem wholly convinced. Insider trading at CommVault currently stands at Neutral. However, they did buy $54,800 worth of shares in the last three months. Transactions have been up and down, with large numbers of sales showing up, followed by intermittent purchases.