American financial services provider Comerica, Inc. (CMA) delivered solid third-quarter results aided by strong deposit growth, robust fee income, and excellent credit quality. Following the news, shares jumped 3.4% to close at $86.93 on October 20.

Comerica posted earnings of $1.90 per share, up 28.4% year-over-year and 26 cents better than analyst estimates of $1.64 per share. (See Insiders’ Hot Stocks on TipRanks)

Additionally, CMA’s net interest income (NII) grew 3.7% year-over-year to $475 million, and noninterest income increased 11.1% year-over-year to $280 million. Despite the low-interest-rate environment, Comerica continued to generate solid NII backed by an increase in its interest-earning assets.

During Q3, Comerica’s loans decreased 7% to $48.13 billion, largely due to a decline of $2.1 billion in Paycheck Protection Program (PPP) loans driven by forgiveness activity. While deposits grew 15% to $79.11 billion backed by customers’ profitability, capital markets activity, and economic liquidity induced by fiscal and monetary policies.

Commenting on the results, Curt C. Farmer, Chairman, President, and CEO of Comerica said, “Solid loan growth in a number of business lines was overshadowed by headwinds from PPP loan forgiveness and reduced auto dealer loans due to supply constraints. Our efficiency ratio was stable as we remained focused on managing expenses while supporting our revenue-generating activities. We expect economic metrics to remain relatively strong over the next year, which bodes well for growth.”

In response to Comerica’s solid performance, Stephens analyst Terry McEvoy lifted the price target on the stock to $100 (15% upside potential) from $80 while maintaining a Buy rating.

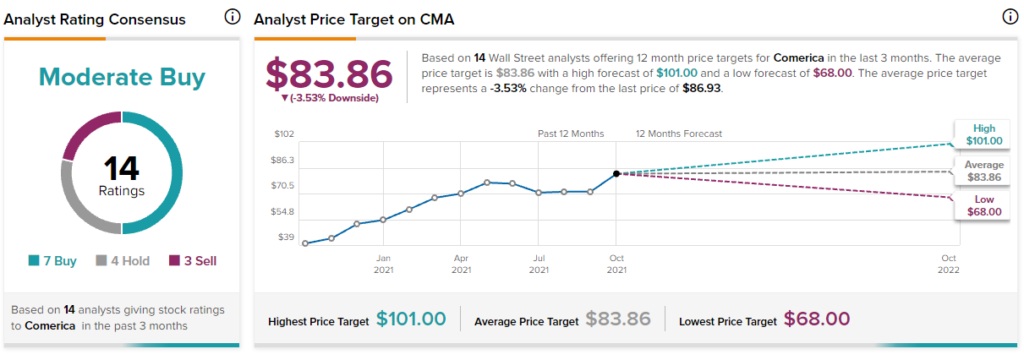

Overall, the stock has a Moderate Buy consensus rating based on 7 Buys, 4 Holds, and 3 Sells. The average Comerica price target of $83.86 implies 3.5% downside potential to current levels. Shares have gained 105% over the past year.

Related News:

Netflix Reports Better-Than-Expected Q3 Earnings

Dover Corp Jumps on Robust Q3 Results, Lifts FY21 EPS

Omnicom Delivers Mixed Q3 Results; Shares Slip After-Hours