Comcast (CMCSA) and ViacomCBS (VIAC) have partnered for the launch of SkyShowtime, a new subscription video-on-demand (SVOD) service, in over 20 territories in Europe. The companies will jointly control and equally invest in the partnership, which will be structured as a joint venture.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Headquartered in New York City, ViacomCBS is a multinational mass media and entertainment conglomerate that operates more than 170 networks and has subscribers in nearly 180 nations. Meanwhile, Comcast is a telecommunications conglomerate based in Pennsylvania. The company offers cable TV, Internet and telephone services.

The SVOD service will offer original series, movies and entertainment shows from ViacomCBS, Sky and NBCUniversal brands. It will also show titles from Peacock, Universal Pictures, Sky Studios, Paramount+ Originals, Paramount Pictures, Nickelodeon and SHOWTIME. (See Comcast stock chart on TipRanks)

Likely to be launched in 2022, SkyShowtime will cover vast audience categories and genres, including documentaries/factual content, local programming, premiere movies, key franchises, kids and family and scripted dramas, among others. (See ViacomCBS stock chart on TipRanks)

The service will be available in Sweden, Spain, Slovenia, Slovakia, Serbia, Romania, Portugal, Poland, Norway, North Macedonia, the Netherlands, Montenegro, Kosovo, Hungary, Finland, Denmark, the Czech Republic, Croatia, Bulgaria, Bosnia and Herzegovina, Andorra and Albania.

The President and CEO of ViacomCBS Networks International, Raffaele Annecchino, said, “As a complement to our recently announced Paramount+ partnership with Sky in the U.K., Italy, and Germany, SkyShowtime represents a huge opportunity to accelerate our market expansion and build a leadership position in SVOD in Europe.”

ViacomCBS’ shares gained 3.7% on Wednesday. It rose another 1% in extended trade to finally close at $40.85.

On August 8, RBC Capital analyst Kutgun Maral maintained a Buy rating on ViacomCBS with a price target of $52 (28.5% upside potential). The analyst expects the company to report earnings per share (EPS) of $0 in the third quarter.

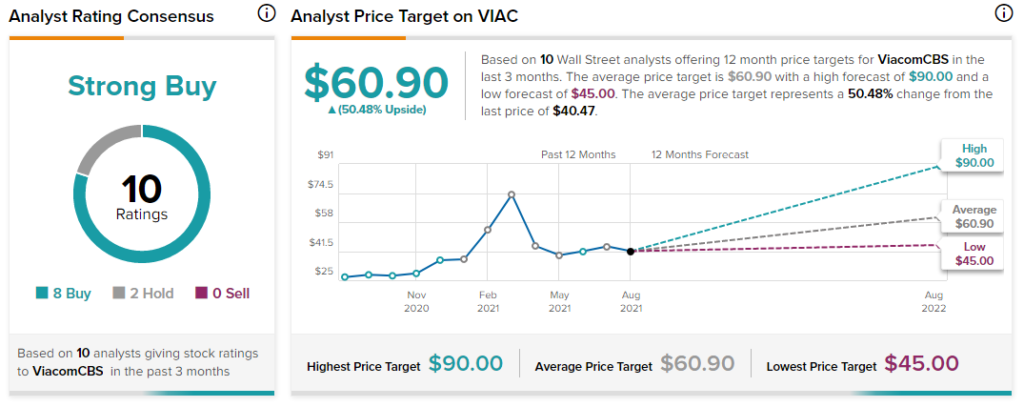

Overall, the stock has a Strong Buy consensus rating based on 8 Buys and 2 Holds. The average ViacomCBS price target of $60.90 implies 50.5% upside potential. The company’s shares have gained 48.1% over the past year.

Last month, Truist Financial analyst Gregory P Miller maintained a Buy rating on Comcast and raised the price target to $70 from $65 (18.6% upside potential).

In a research note to investors, the analyst said, “Comcast’s cable division is producing exceptional results, with a surprisingly strong turn-around in NBCU seen driven by theme parks and production, along with a solid momentum in Sky rebound.”

Overall, the stock has a Moderate Buy consensus rating based on 12 Buys, 2 Holds and 1 Sell. The average Comcast price target of $66.64 implies 12.9% upside potential. The company’s shares have gained 36.3% over the past year.

According to TipRanks’ Smart Score rating system, Comcast scores an 8 out of 10, suggesting that the stock is likely to outperform market averages.

Related News:

Target’s Shares Fall Pre-Market Despite Q2 Results Exceeding Expectations

Roku adds 17 New Channels to its Linear Lineup

Overstock to Repurchase $100M Common Stock; Analysts Remain Bullish