Comcast (CMCSA) delivered a third consecutive quarter of double-digit EBITDA growth and performed well across the board in 1Q 2021. The company also added the most customer relationships in its history, affirming growth in key segments.

The telecommunication conglomerate delivered $27.2 billion in revenue, representing a 2.2% year-over-year increase. Revenue growth was mostly driven by a 5.9% increase in Cable Communications revenue which amounted to $15.8 billion.

Comcast’s net income was up 55.1% to $3.3 billion and adjusted net income totaled $3.5 billion representing an 8.1% year-over year increase. Adjusted EBITDA totaled $8.4 billion while earnings per share increased 54.3% to $0.71 and adjusted EPS surged 7% to $0.76.

During the quarter, total customer relationships increased by 380,000 to 33.5 million, driven by nearly 370,000 increases in residential customer relationships. Comcast also reached break-even with its theme parks as it successfully re-opened Universal Studios in Hollywood. (See Comcast stock analysis on TipRanks).

“At Sky, customer relationship additions increased by 221,000, marking the best first quarter result in six years despite the lockdowns imposed throughout Europe. Across all parts of the company, our teams are executing at a high level and collaborating to drive growth and innovation, and I couldn’t be more excited about our future,” said CEO Brian L. Roberts.

Oppenheimer analyst Timothy Horan upgraded Comcast to a Buy from a Hold, impressed by the company’s improving growth outlook. He reiterated a $75 price target on the stock, implying 33.57% upside potential to current levels.

Horan stated, “CMCSA’s growth outlook is improving across each segment coming out of COVID and we think now is an attractive entry point for investors. Cable’s performance has been resilient due to broadband, and we are starting to see revenue growth and margin improve for Wireless and Business Services. NBCU has been recovering better than expected; with advertising and content production ramping strongly.”

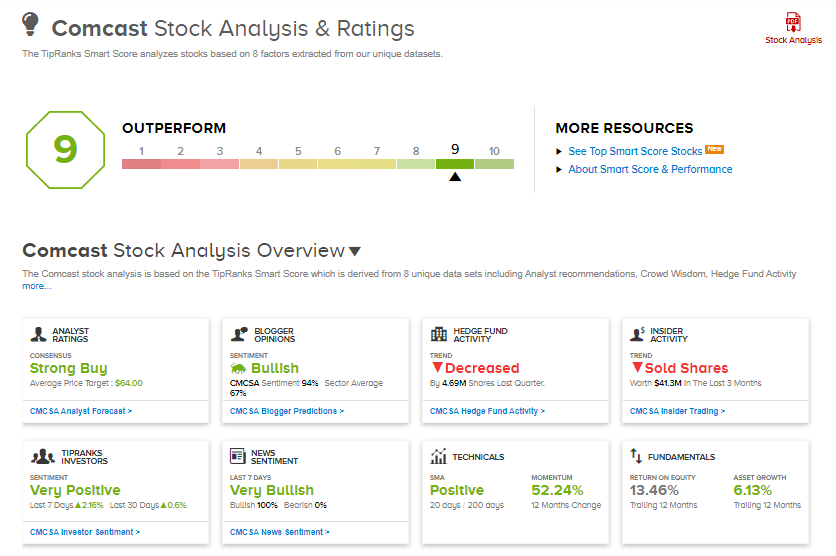

Wall Street is optimistic about Comcast’s long term prospects. Consensus among analysts is a Strong Buy based on 14 Buys, 1 Hold, and 1 Sell rating. The average analyst price target of $64 implies 13.98% upside potential to current levels.

CMCSA scores 9 out of 10 on TipRanks’ Smart Score rating system, implying it is likely to top market expectations.

Related News:

Woven Acquisition To Help Slack Rival Microsoft And Google

Baidu To Launch Autonomous Ride-Hailing Services In Beijing

Ford Eyes Licensing Deal For Volkswagen’s Electric Vehicle Technology – Report