Colgate-Palmolive reported stronger-than-expected 3Q results on Friday, reflecting increased pricing and improved organic volumes across all business divisions. Shares of the consumer product manufacturer closed 2.9% higher on Friday.

Colgate-Palmolive’s (CL) 3Q adjusted EPS soared 11% to $0.79 year-on-year and surpassed analysts’ expectations of $0.70. Revenues of $4.15 billion also beat Street estimates of $3.98 billion and grew 5.5% year-over-year, mainly fuelded by a 4.5% increase in pricing and a 3% growth in organic volumes.

Colgate-Palmolive’s CEO Noel Wallace said, “It is rewarding to see the growth strategies we are implementing bear fruit. While we continue to see elevated demand in personal care and home care related to the virus, premium innovation is also driving growth across all of our product categories. We also continue to see strength in eCommerce, led by our Hill’s business.” (See CL stock analysis on TipRanks).

For the full-year the company expects net sales and organic sales both to increase in the mid-single digit range. Organic sales is forecast to achieve the high-end of the growth guidance range. Adjusted EPS is anticipated to grow between 6% and 7%.

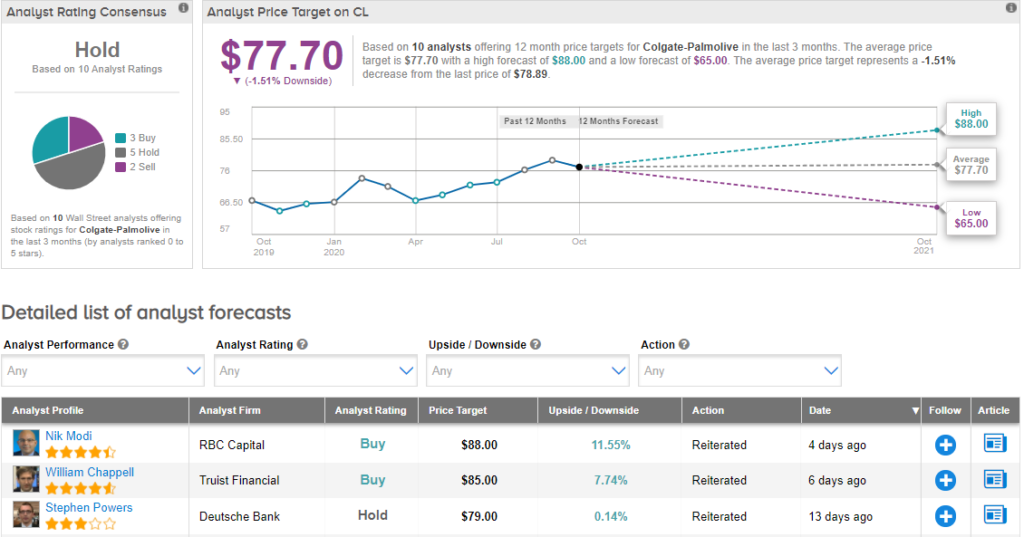

Ahead of its earnings release, Truist Financial analyst William Chappell raised the stock’s price target to $85 (11.6% upside potential) from $80 and reiterated a Buy rating. Chappell’s revised price target reflects multiple expansions in the consumer product space. In an Oct. 26 note to investors, the analyst said that Colgate would benefit from improving global hygiene practices due to COVID-19 and expects the pandemic to “permanently alter consumers’ hygiene practices.”

Currently, the Street is sidelined on the stock. The Hold analyst consensus is based on 5 Holds, 3 Buys and 2 Sells. With shares up nearly 14.6% year-to-date, the average price target of $77.70 implies a moderate downside potential of 1.5% to current levels.

Related News:

Activision’s 3Q Profit Soars 132% On Strong Gaming Demand

Starbucks Tops 4Q Estimates, Sees Strong Global Comps In FY21

Columbia Sportswear Sinks 17% After Hours On Weak 3Q Earnings