Cryptocurrency exchange platform company Coinbase Global Inc. (COIN) is scheduled to release its second-quarter earnings results tomorrow after the market closes.

Based in the U.S., Coinbase Global provides end-to-end financial infrastructure and technology for the crypto-economy. It generates almost all its net revenue from transaction fees from trades that occur on its platform.

With the crypto economy’s recent volatility, investors will be waiting for the company’s quarterly results, seeking answers to many of their concerns.

For the second quarter, the consensus estimate for Coinbase Global earnings is pegged at a loss of $2.47 per share. This implies a significant deterioration from the earnings of $6.42 per share reported in the second quarter of 2021.

Disappointingly, the consensus estimate for the company’s revenues stands at $879.69 million, much lower than the previous quarter’s tally of $1.17 billion and less than half of the revenues of $1.77 billion generated in the prior-year quarter.

Coinbase’s Website Traffic Trends Hint at a Poor Q2 Show

A look at Coinbase’s website traffic points out that the company’s second-quarter revenues may disappoint.

Per the TipRanks Website Traffic tool, the footfall on coinbase.com declined 16.99% in June versus May. Further, it decreased 25.32% in the second quarter of 2022 versus the first quarter of 2022.

What’s Happening with COIN?

COIN stock has been very volatile due to uncertainties in the crypto market. The stock has lost 66% of its market capitalization over the past year.

Interestingly, it has surged over 50% in the last five trading days. Last Wednesday, the stock jumped over 20% after it announced an agreement with asset management giant BlackRock (BLK) to give direct access to the latter’s institutional clients to buy and sell crypto, starting with bitcoin trading.

Further, the proposed crypto regulation bill is expected to ease crypto market volatility with the potential to boost COIN’s revenues.

On the flip side, Coinbase has recently come under the radar of the SEC, as the regulator is investigating crypto listings.

Wall Street’s Take on COIN

Dan Dolev of Mizuho Securities believes the last week’s share price jump is premature. He stated, “At ~$1.8bn of crypto trading volume generated on the COIN platform, Wednesday’s volumes were barely above July’s ‘crypto winter’ levels, suggesting that the hype was premature.”

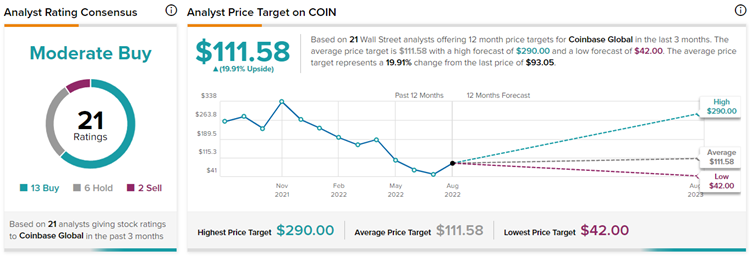

According to TipRanks, analysts have a Moderate Buy consensus rating on COIN, which is based on 13 Buys, six Holds, and two Sell ratings. COIN’s average price forecast of $111.58 implies 19.91% upside potential.

Final Thoughts

COIN stock was up 4.7% on Friday. It is trading over 5% higher in the pre-market trading session today. Despite its recent recovery, COIN stock is miles away from its peak of $350 levels seen in November last year.

The expected drop in COIN’s volumes and revenues in its second-quarter results is imminent. However, investors will wait for more details on the implications of the proposed bills and other recent developments.