It’s been a wild few months for cryptocurrency stocks. Particularly those like Coinbase (NASDAQ:COIN), who depend on cryptocurrency in general to have value, not any one particular cryptocurrency. But now, Coinbase is taking its act on the road and looking to make some friends in Washington to keep itself from being regulated out of existence. It’s already down just a bit in Tuesday afternoon’s trading session, but can it save itself in Washington? More specifically, Coinbase’s CEO Brian Armstrong will be making the trip, meeting privately with a slate of House Democrats to talk about the Securities and Exchange Commission lawsuit facing Coinbase, among other things.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

Interestingly, Armstrong is actually looking for a certain amount of regulation; he’s complained in the past about a “…lack of clear rules” covering the market. This is a common lament; the government may put rules in place, but they’re so unclear or so overly generic that anyone can be accused of failing to obey at any time.

In fact, Coinbase just landed a win only recently thanks to recent issues surrounding Ripple (XRP-USD). Judge Analisa Torres turned in a win for Coinbase by declaring that Coinbase did not, in fact, violate SEC rules by offering the XRP coin. That proved an opportunity for Ripple Labs as well, who came out and declared the SEC a “bully” who has “…sowed confusion in the market.”

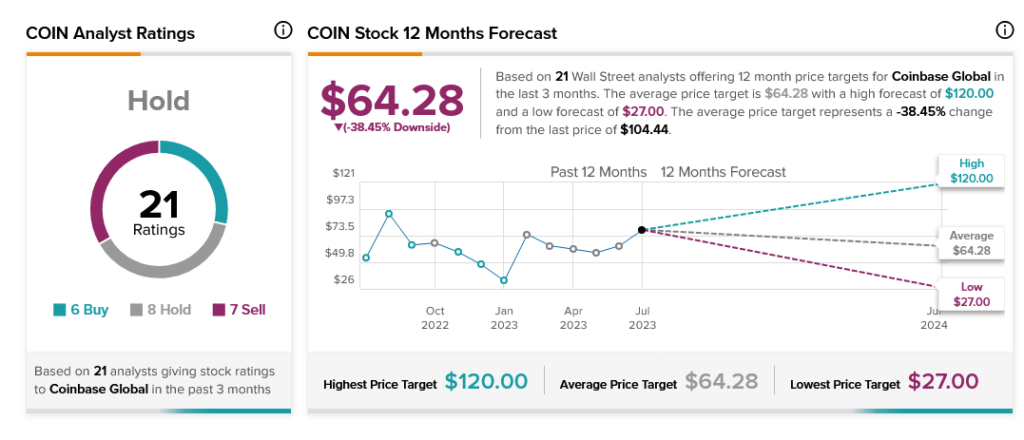

All this uncertainty is reflected in analysts as well, who have a near-perfect split on opinion about Coinbase stock. With six Buys, eight Holds, and seven Sells, there’s clear uncertainty, and that adds up to a Hold rating. Further, Coinbase offers a terrifying 38.45% downside risk thanks to its average price target of $64.28.