Crypto exchange Coinbase Global (NASDAQ:COIN) has restarted the trading of XRP-USD, the native token of blockchain company Ripple Labs, on its platform following a U.S. District Judge’s ruling that Ripple did not violate federal securities law by selling XRP on public exchanges. XRP surged over 70% on Thursday in reaction to the court’s ruling. Shares of crypto-related companies Coinbase, Marathon Digital (MARA), Riot Platforms (RIOT), Hut 8 Mining (HUT), and Hive Blockchain (HIVE) were up 25%, 14%, 15%, and 17%, respectively, on Thursday.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Coinbase Assets tweeted that XRP is now live on coinbase.com, the Coinbase iOS, and Android apps and that customers can buy, sell, convert, send, receive, or store XRP.

Earlier, Coinbase’s chief legal officer Paul Grewal said on Twitter, “We’ve read Judge [Analisa] Torres’ thoughtful decision. We’ve carefully reviewed our analysis. It’s time to relist.”

Crypto exchange Kraken also resumed XRP trading on its platform for U.S. users.

Ripple Ruling Favorably Impacts Coinbase

The court’s ruling in the litigation involving Ripple and the Securities and Exchange Commission (SEC) gave crypto investors hope that other altcoins and crypto firms that have been sued by the SEC might also not be found guilty of the alleged violation of the securities laws.

The FTX debacle last year crushed the crypto market and made the SEC increase its crackdown on the crypto market. In June, the SEC sued Coinbase and rival crypto exchange Binance (BNB-USD). The SEC alleged that Coinbase has been operating its crypto asset trading platform as an unregistered national securities exchange, broker, and clearing agency.

The SEC also alleged that since at least 2019, Coinbase has made “billions of dollars unlawfully facilitating the buying and selling of crypto asset securities.” In reaction, Coinbase has been aggressively responding to the SEC’s allegations and has like many others raised concerns over the lack of clarity over crypto regulations.

On Thursday, Oppenheimer analyst Owen Lau expressed optimism that following the clarity in Ripple’s case, there is a higher probability that the resolution of Coinbase’s lawsuit could come earlier than anticipated. Lau has a Hold rating on Coinbase.

Is Coinbase a Buy or Hold?

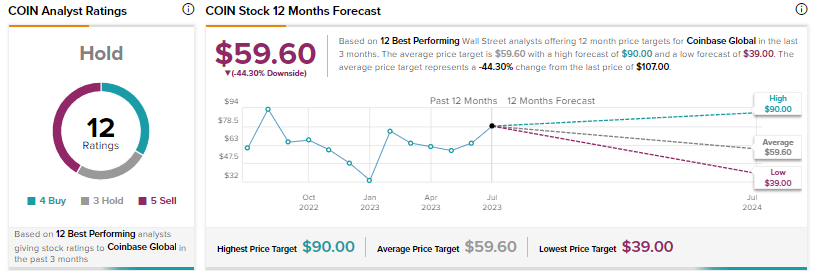

Of the 12 Top Wall Street Analysts covering Coinbase Global stock, four have a Buy rating, three have a Hold recommendation, while five rate it a Sell. Tracking the ratings of the top analysts could provide useful insights to investors, given the solid success rates and attractive returns on trades of these analysts.

The average price target of $59.60 implies a possible downside of 44.3%. COIN shares have skyrocketed 202% year-to-date.