Back-end semiconductor equipment and services provider Cohu Inc. (COHU) has pared down its term loan B (TLB) facility by a further $100 million, which now brings the outstanding principal of its TLB to about $104 million.

Consequently, the company now expects to save about $0.8 million in interest expense in Q3. In conjunction with the reduction in the loan amount, the company expects to record a non-cash charge of about $1.7 million for loss on debt extinguishment.

Cohu President and CEO Luis Muller said, “Deleveraging continues to be a priority for us and we are pleased to have reduced our TLB by ~$202 million, so far, during the Fiscal year 2021.” (See Cohu stock chart on TipRanks)

Cohu funded this debt reduction with proceeds from the recent sale of its Printed Circuit Board Test business to Mycronic AB for a consideration of $125.4 million.

On June 30, Rosenblatt Securities analyst Scott Graham initiated coverage on the stock with a Buy rating and a price target of $65 (76.7% upside potential). According to Graham, the semiconductor industry, driven by AI penetration in major Semi-sub sectors, is in a “Mother of All Cycles.”

The analyst expects “Cohu’s sales to continue to benefit from this backdrop and its targeted strategies which seek to tap faster-growth niches and seculars in its markets.”

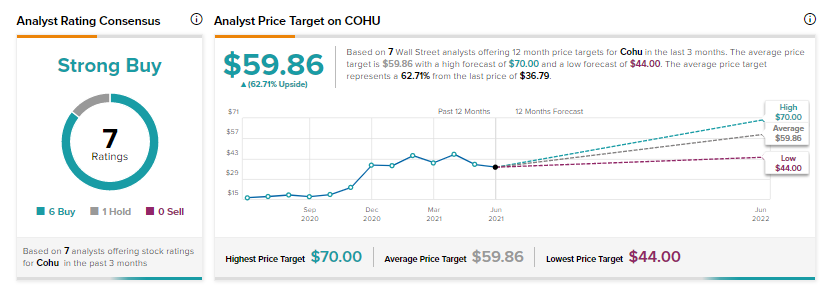

Based on 6 Buys and 1 Hold, consensus on the Street is a Strong Buy. The average Cohu price target of $59.86 implies 62.7% upside potential. Shares are up 121.8% over the past year.

Related News:

Repay Joins Hands with Premier to Provide Accounts Payable Solutions to Healthcare Providers

Walmart Launches Its Own Insulin Brand

Valley National Bancorp Snaps Up The Westchester Bank

5 Top Dividend Stocks