Sometimes a company can beat the odds even when its earnings report doesn’t quite fit the bill. That happened to software company Cognyte Software (NASDAQ:CGNT), as it posted an earnings report that left investors disappointed, but not sufficiently so that they weren’t willing to buy in. Shares of Cognyte were up 18.77% in Tuesday’s trading session.

Cognyte posted a loss for its fourth quarter of 2023, coming in at -$0.16 per share. That was a miss against analyst consensus, which looked for -$0.13 per share. Things only got worse from there, as Cognyte posted revenue of $73.26 million. That beat projections calling for $66.8 million, which sounds pretty good until you consider that it was down 41.4% against this time last year.

Management’s projections weren’t exactly good news, either. Diluted EPS figures were projected “…at the midpoint of our revenue outlook” at -$0.60 per share. However, there was one bright spot, as Cognyte looked for revenue to come in at $300 million at the midpoint, within a range of plus or minus 2%. That would represent a growth of 6%. Cognyte’s CEO, Elad Sharon, noted that Cognyte “…continued to win large deals and increase backlog,” which allowed it to “…raise our revenue guidance for fiscal 2024.”

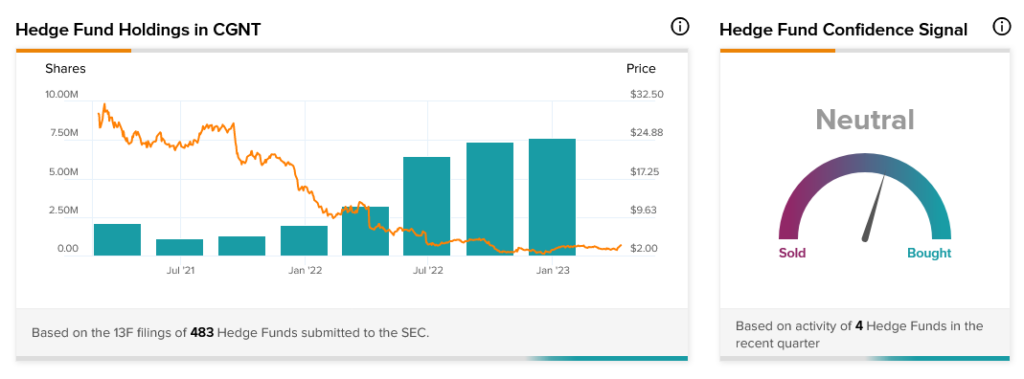

Despite these unusual results, one group of investors still seems very interested in Cognyte: hedge funds. Hedge fund confidence sentiment is currently on the high side of Neutral, and hedge funds added another 256,000 shares of Cognyte just in the last quarter. Better yet, this represents the sixth consecutive quarter that hedge funds added on to their Cognyte holdings.