Shares of professional services company Cognizant (NASDAQ:CTSH) are nosediving today after an unimpressive third-quarter showing and major analyst downgrades.

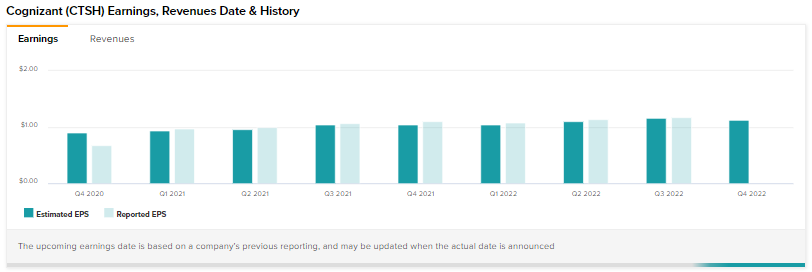

The IT major’s revenue increased by 2.5% year-over-year to $4.86 billion but missed the cut by $140 million. EPS at $1.17, on the other hand, came in ahead of expectations by $0.01. Additionally, the company increased its stock buyback program by $2 billion.

Nonetheless, CTSH’s top brass noted that top line and bookings came in below expectations as fulfillment challenges were exacerbated by uncertain macroeconomic conditions. Further, bookings during the quarter dropped by 2% as compared to the year-ago period.

CTSH now expects fourth-quarter revenue to land between $4.72 billion and $4.77 billion. This indicates a drop of 0.2% to 1.2%. Revenue for the full-year 2022 is anticipated at $19.3 billion.

In response to this performance, UBS’ Rayna Kumar has lowered the price target on CTSH to $62 from $76 while maintaining a Hold rating.

BMO Capital’s Keith Bachman too has lowered the price target on the stock to $65 from $73 while also slashing the rating to a Hold from a Buy.

The analyst expects 2023 to be a tough year for the IT space and adds that while CTSH is inexpensive at current levels, there seems to be no catalyst in the short term for the stock.

Read full Disclosure