Canadian National Railway (CNR) announced its second-quarter financial results on July 20 after market close. The profit of the largest rail network operator nearly doubled in the second quarter as CN Rail reported it was emerging from the COVID-19 freight volume crisis.

Revenue came in at C$3.6 billion in the second quarter of 2021, an increase of 12% from C$3.21 billion in the prior-year quarter. Revenue ton miles (RTMs) increased by 13% year-over-year.

The Montreal-based railway earned C$1.03 billion (C$1.46 per share) in Q2 2021, up from C$545 million (C$0.77 per share) in Q2 2020.

On an adjusted basis, CN earned C$1.06 billion (C$1.49 per share) for the quarter, compared with C$988 million (C$1.28 per share) a year ago.

The operating ratio improved to 61.6% in the second quarter.

CN Rail’s President and CEO JJ Ruest said, “CN continued to deliver strong operating and financial performance in the second quarter, driven in large part by the dedication of our people and the ongoing long-term investments we are making in our network, equipment, technology and talent. We enter the second half of 2021 focused on executing for our customers and leveraging our strong network performance to safely and sustainably drive long-term value creation for all of our stakeholders. Our proposed combination with Kansas City Southern has received overwhelming support from a broad base of stakeholders because it will enhance competition and drive economic growth in North America. We are confident in our ability to obtain the necessary approvals and successfully close this pro-competitive combination and look forward to delivering the many compelling benefits to customers, employees, labor partners, and the communities in which we operate.”

The positive earnings report came as the company pursues a Kansas City Southern takeover. CN Rail is awaiting a decision from the Surface Transportation Board which will determine if it can strike a deal. (See Canadian National Railway stock charts on TipRanks)

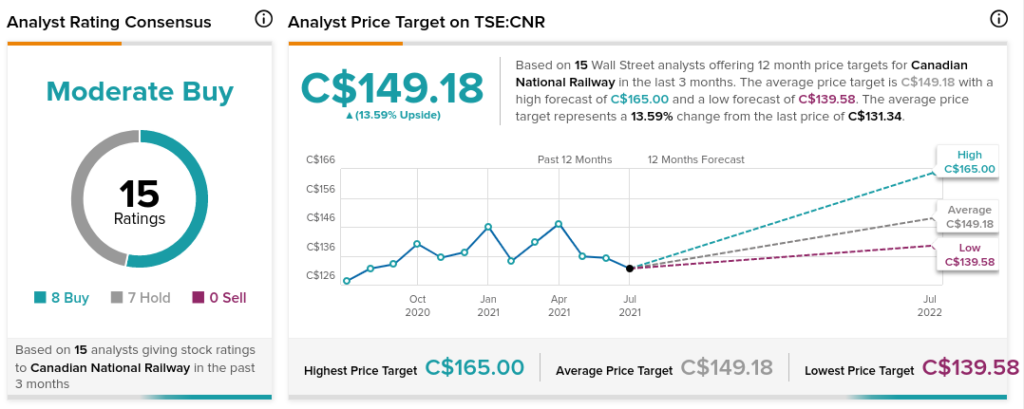

Following the results, Cowen analyst Jason Seidl maintained a Hold rating on CNR and lowered its price target to C$140. This implies 6.2% upside potential.

Seidl noted that CN Rail’s Q2 results were below his expectations due to high costs and lower-than-expected revenue.

Overall, consensus on the Street is that CNR is a Moderate Buy based on 8 Buys and 7 Holds. The average Canadian National Railway price target of C$149.18 implies 13.6% upside potential to current levels.

Related News:

CP Rail Pursues Kansas City Takeover in Case the CN Deal Falls Through

BRP Posts $244M Profit in Q1, Raises Full-Year Guidance; Shares Down 2%

Transat Loss Widens in Q2, Revenues Plummet; Stock Pops More Than 4%