Shares of Clovis Oncology, Inc. (CLVS) shot up 22.4% on Thursday after the company reported promising data for Rubraca (rucaparib), a drug designed to treat ovarian cancer. The biopharmaceutical company engages in the acquisition, development, and commercialization of cancer treatments.

The phase 3 trial, ATHENA-MONO (rucaparib vs placebo), was conducted on 538 women suffering from high-grade ovarian, fallopian tube, or primary peritoneal, cancer. According to the company, patients were divided into two groups for the trial – newly diagnosed patients with advanced ovarian cancer following successful treatment with platinum-based chemotherapy and selected randomly.

The drug was successful in meeting the primary endpoint and significantly improved the progression-free survival (PFS) of patients in comparison with placebo treatment.

In the randomly selected patient group, the median PFS for patients treated with Rubraca was 20.2 months, whereas for those with placebo was mere 9.2 months.

What’s Next?

Clovis seeks to submit a supplemental New Drug Application to the US Food and Drug Administration in the second quarter of 2022. Also, the company said it was planning to submit a Type II Variation request to European regulators in the third quarter for a “first-line maintenance treatment indication for women with advanced ovarian cancer.”

Moreover, the company awaits results from the ATHENA-COMBO trial (rucaparib+nivolumab vs rucaparib), which is expected to be released in the first quarter of 2023.

Stock Rating

On March 31, H.C. Wainwright analyst Edward White maintained a Buy rating on Clovis with a price target of $5, implying 147.5% upside potential from current levels.

White said, “The company has seen stagnation with Rubraca sales in the second-line. Management noted that this is likely an impact from the COVID-19 pandemic and its consequences of fewer detections and diagnoses of patients. The company believes more patients could be diagnosed as the pandemic wanes.”

Further, the analyst expects Rubraca sales to “pick up dramatically even if the company only picks up a third of the first-line market.”

The stock has a Moderate Sell consensus rating based on one Buy and two Sells. CLVS’ average price target of $3.17 implies 56.9% upside potential from current levels.

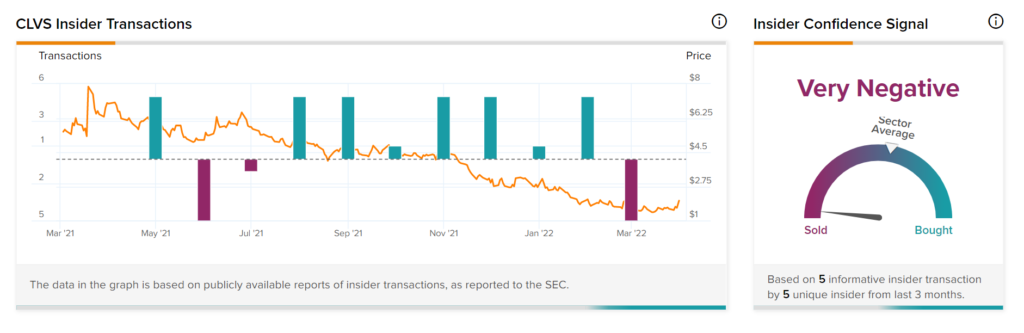

Insider Trading

Based on the recent corporate insider activity, sentiments seem Very Negative about the stock. This means that over the past quarter there has been an increase in insiders selling their shares of CLVS.

Takeaway

CLVS has declined 35.7% so far this year. It is likely that successful approval from FDA would mark a big win for Clovis and help the stock regain prior price levels.

Download the TipRanks mobile app now

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Read full Disclaimer & Disclosure

Related News:

Teva Gains 6.4% on Another Opioid Case Settlement

Hackers Fool Two Tech Giants; Will Regulators Intervene?

Analysts Bullish on Gildan Despite Volatile Performance