Next-generation healthcare company Clover Health (CLOV) has posted upbeat revenues for the third quarter of 2021. Total revenues of $427.2 million surpassed analysts’ expectations of $417.8 million. The company had reported total revenues of $169 million in the third quarter of 2020.

Markedly, total revenues comprised $204 million in Medicare Advantage premiums and $223 million in Direct Contracting revenue. As of September 30, 2021, while lives under Clover Management were about 129,100, up 125% year-over-year, lives under Clover Assistant Management grew 223% to about 94,000.

The company recorded a normalized Medicare Advantage (MA) Medical Care Ratio (MCR) of 94.8%, compared to 96.4% in the same quarter last year. Normalized adjusted EBITDA came in at a negative $61.1 million, higher than the negative $36.8 million in the prior-year quarter. (See Clover Health stock charts on TipRanks)

Outlook

The CEO of Clover Health, Vivek Garipalli, said, “As we look forward to 2022, we believe our solid execution will lead to continued rapid growth of Lives under Clover Management and lower MCR through enhanced operational efficiencies and improved clinical care.”

For 2021, the company projects total revenues to be in the range of $1.42 billion to $1.47 billion. Normalized MA MCR is expected to be in the range of 94% to 96%. Additionally, normalized adjusted EBITDA loss is expected to be between $250 million and $230 million.

See Insiders’ Hot Stocks on TipRanks >>

Analysts Recommendation

Overall, the Street is bearish on the stock and has a Moderate Sell consensus rating based on 1 Hold and 1 Sell. The average Clover Health price target of $8.50 implies 5.85% upside potential to current levels. Shares have declined almost 20% over the past year.

Risk Analysis

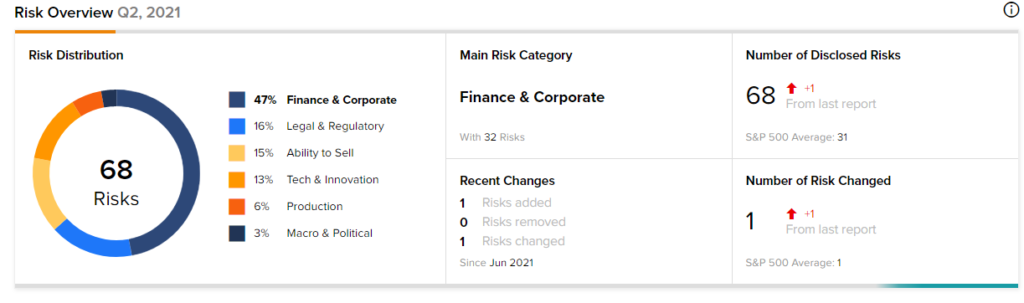

According to the new TipRanks’ Risk Factors tool, the Clover Health stock is at risk mainly from three factors: Finance and Corporate, Legal and Regulatory, and Ability to Sell, which contribute 47%, 16%, and 15%, respectively, to the total 68 risks identified for the stock.

Related News:

AbbVie Presents Data from Two Phase 3 Trials on Risankizumab

Lucid Opens First Studio in Washington; Shares Rise 12.6%

Exela Dips 11.5% on Quarterly Loss